Experts gather to discuss fiscal reforms for cleaner and efficient fuels and vehicles in the Philippines

The Global Fuel Economy Initiative helped support a workshop in the Philippines to discuss proposals for new fuel and vehicle reforms. The “National Workshop on Fiscal Policies for Promoting Cleaner Fuels and Vehicles” on 5th April 2017 saw a range of presentations and discussions among representatives from government agencies, civil society organizations and research and academic institutions on the DOF’s touted vehicle and fuel tax reforms, which have the potential to offset the negative environmental and energy impacts of transportation by influencing consumer choice and levels of consumption.

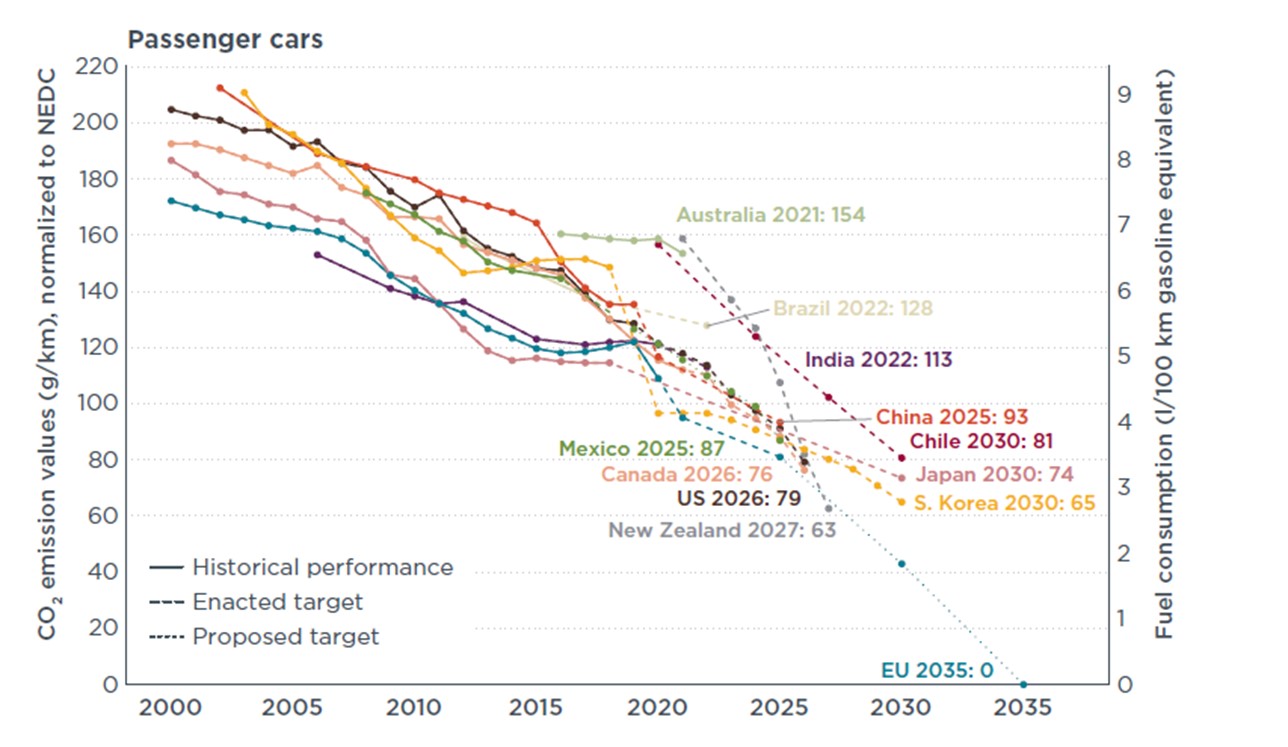

UN Environment Programme Officer Bert Fabian provided an overview on the doubling of light-duty vehicle efficiency worldwide, citing examples from developing countries in which fuel economy policies, including fiscal reform, had proved effective.

“There are more than 1 billion vehicles globally, which is set to rise to 2.5 billion by 2050 – with half-a-billion in ASEAN countries,” Mr Fabian said. “Implementing fuel economy policies can substantially reduce CO2 emissions, reduce fossil fuel consumption and associated fossil fuel expenditures.”

DOF Fiscal Policy and Planning Office Division Chief Johanna Hortinela said the proposed tax reform entailed a progressive tax that ensured those who consumed more would pay more tax than those who consumed less. She said the top 10 percent of Filipino households accounted for 51 percent of fuel consumption. Ms Hortinela said the proposed reform progressively increased the vehicle excise tax on all segments based on price brackets, covering motor vehicles with four or more wheels powered by gasoline, diesel or any other form of motive power except those solely powered by electricity. The tax reform did not apply to buses, trucks, cargo vans for freight and jeepneys. She said the vehicle excise tax reform was primarily aimed at equitably raising revenues and discouraging the purchase of automobiles, while the fuel excise tax reform was aimed at supporting climate change mitigation by raising funds for climate-resilient infrastructure to address congestion and reduce the negative impacts of fuel consumption. About 60 percent would be allocated to infrastructure, while 40 percent of fuel excise tax reform revenue would go to a targeted transfer program to help the poor and vulnerable.

Clean Air Asia Transport Program Manager Alvin Mejia presented the results of a study conducted by Clean Air Asia and former International Energy Agency expert Alex Koerner that examined the impact of the DOF’s proposed fuel and vehicle excise tax reform. According to the study, vehicle excise tax reform has the potential to elicit a 3.2 percent annual fuel economy improvement rate between 2013 and 2020, or average light-duty vehicle fuel economy of about 6.2 Lge/100km by 2020. A higher fuel excise together with a presumed 60 percent increase in the price of crude oil is projected to drive an annual improvement rate of 2.1 percent, resulting in light-duty vehicle fuel economy of about 6.7 Lge/100km by 2020. However, since the proposed DOF vehicle excise tax reform does not provide differentiated excise tax based on fuel efficiency, the benefits of having more efficient vehicles would not be maximized. In addition, the tax was based on vehicle prices and did not provide benefits for more efficient vehicles, such as hybrid and electric vehicles.

Mr Mejia also facilitated a panel discussion on the issues surrounding the proposed tax reform, during which Engineer Jean Rosete from the Department of Environment and Natural Resources posited that an age-based vehicle scheme might be worth adopting in the Philippines as public utility buses were predominantly imported secondhand and all public utility jeepney fleets were secondhand. Maria Corazon Japson from the Department of Transportation supported the move, saying that of the public utility vehicles (PUVs), only jeepneys lacked an age limit.

Department of Energy (DOE) representative Jesus Anunciacion said the DOE’s work included harmonizing government policies on alternative fuels, and that the deployment of electric vehicles for testing purposes and fast-charging infrastructure was under consideration. Mr Anunciacion hoped that such policies would encourage cleaner technologies and help make them cheaper and more accessible.

Dr Manny Biona from the Center for Engineering and Sustainable Development Research at De La Salle University said such efforts and fuel price increases were more effective if undertaken in conjunction with improvements to public transport systems. He also emphasized the need to manage in-use vehicles via more stringent emissions testing.

Among the workshop presenters was Dr Nuwong Chollacoop from Thailand’s National Science and Technology Development Agency, who shared the country’s experience in implementing a CO2-based vehicle taxation scheme, which subjects new vehicles sold in Thailand to an excise tax based on CO2 emissions rather than, as before, engine capacity alone.

Dr Chollacoop said the tax structure, which came into effect in January 2016, introduced substantially lower tax rates for hybrids, eco-cars and lower-emission vehicles. For example, passenger cars emitting from 151-200 g/km were taxed 35 percent, while electric, fuel cell and hybrids were subject to 10 percent excise duty. He said that from 2013 to 2016, vehicle sales peaked in 2013, primarily those with 7-8 Lge/100km fuel economy. This was attributed to Thailand’s First-Car Buyer Programme introduced in 2012, under which first-time car buyers received THB 100,000 cash back. As a result of the CO2-based taxation scheme, fuel economy has improved, including for mini multi-purpose vehicles and SUVs of the same or larger engine size. To boost domestic demand of BEVs, PHEVs and HEVs, in March 2017 Thailand’s government announced a further excise tax reduction from 10 percent to 2 percent for BEVs, halved for PHEVs and HEVs.

The workshop was organized by Clean Air Asia, the DOF and United Nations Environment, with support from the Global Fuel Economy Initiative and the European Union.