GFEI supports Peru to explore vehicle tax options for improving fuel economy

The Global Fuel Economy Initiative (GFEI) has been supporting Peru to develop fuel economy policy proposals, including potential pathways to better align its vehicle taxation system with vehicle fuel efficiency. GFEI works with countries to help them cut harmful CO2 emissions from vehicles, and GFEI’s training and capacity building support in Peru has been led by GFEI partner the International Council on Clean Transportation (ICCT). In November 2018, Francisco Posada, senior researcher at ICCT, met with representatives from the Ministry of Environment (MINAM) of Peru to present detailed options of possible ways to adjust fiscal incentives to promote improved fuel economy. The meeting was a follow up from the workshop and training on fuel economy feebate system that was held in Peru in January 2018.

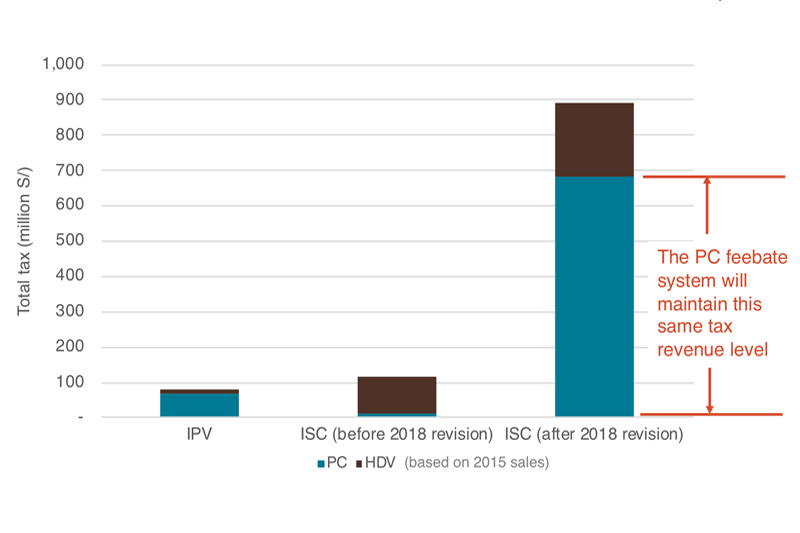

As Figure 1 (right) shows, there are two types of taxes that are applied to vehicles in Peru: ownership tax (IPV), and excise tax (ISC). According to a rough estimate based on vehicles sold in 2015, the amount of revenue from the IPV ownership tax is relatively low– lower than 100 million Soles a year. There was a major revision of the ISC excise tax from May 9, 2018, which has significantly increased government revenues from the tax from slightly over 100 million Soles to almost 900 million Soles a year. A significant share of the tax income increase comes from gasoline passenger cars, due to an increase in the tax rate from 0 to 10%. The vehicle taxation revision benefits the government budget, but its design only partly takes account of the environmental impact of different fuel types, without linking to the relative fuel efficiency of vehicle models.

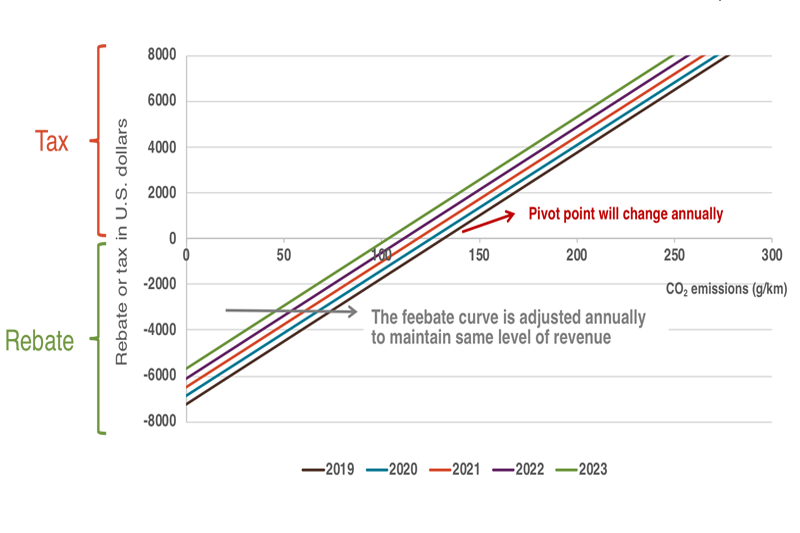

In the meeting Mr. Posada presented a concept proposal to enhance vehicle taxation in Peru with a feebate design that links the taxation to vehicle fuel efficiency. In response to concerns raised by the Ministry of Economy and Finance in the January 2018 workshop around need to maintain revenues from vehicle and fuel taxation, the ICCT proposals show how it is possible to create a feebate system for passenger cars (PCs) that maintains the same tax revenue level.

The proposed feebate system is evaluated bythe feebate tool developed by GFEI partners. This approach could help Peru to reduce average fuel consumption and CO2 from the passenger car fleet by 3% each year. As Figure 2 (right) shows, in response to projected improvements in fleet average fuel consumption, the taxation design is proposed to change annually from 2019 to 2023 to maintain similar revenue levels for the government.

In the meeting, Mr. Posada noted that the proposal that he presented is still conceptual. It aims to support communication among Peru ministries to consider the feasibility of developing a feebate system and its potential impact. Designing an actual policy will need further comprehensive analysis of the market and a variety of elements.

Mr. Luis Ibañes and Ms. Guiselle Castillo from MINAM highlighted the importance of getting agreement between MINAM’s Climate Change branch and the Ministry of Economy and Finance for improving the vehicle tax system. They suggested that it would help this process to identify a legal foundation for feebate development, for example, by explicitly linking the fuel efficiency tax system with Peru’s NDC program for climate change. They also suggested that the feebate design could also start as a pure fuel efficiency tax system (i.e., no rebate given, and tax starts at zero for Hybrids and EVs as is the current program design), while taking into account criteria pollutant impacts in order to get buy-in from stakeholders given that was the original intention of the ISC (i.e., differentiating diesel and gasoline PM emissions and charging accordingly to PM emissions). In addition, there is a potential chance to pair the feebate or fuel efficiency tax system with a fuel efficiency labeling program and enhance the existing vehicle type approval procedure.

The meeting was able to get strong engagement from MINAM on the idea of developing a feebate system for passenger vehicles in Peru and collected valuable feedback on the concept. ICCT will incorporate feedback into the proposal and provide a final memo for Ministry of Environment to discuss the feebate concept among different branches and with other ministries like the Ministry of Economy and Finance.