North Macedonia introduces CO2-based vehicle tax

On 1 January 2020, North Macedonia introduced a new tax to promote fuel economy for passenger vehicles (cars, motorbikes and vans for the combined transport of people and goods). GFEI, through UN Environment and the Regional Environment Center (REC) have provided extensive training and policy support for more than five years, and have been instrumental in advising about the CO2-based design of the new vehicle tax.

Macedonia first established a fuel economy baseline in 2013, and a second phase of support commenced in 2015. A National Working Group was established in early 2016 to monitor and support project implementation, comprised of the Ministry of Economy - Department of Vehicles, the Faculty of Information Technology, University of Niš (Serbia), the Ministry of Environment and Physical Planning, the Macedonian Environmental Information Centre, the Ministry of Transport and Communications, Department of Freight and Passenger Transport and the Ministry of Interior - Department of Vehicles. By 2019 proposed national policy had been drafted and reviewed with support from UNEP, and included the following:

- Replacement of the current excise duty on vehicle imports with a new vehicle tax

- A proposed subsidy program for clean vehicles

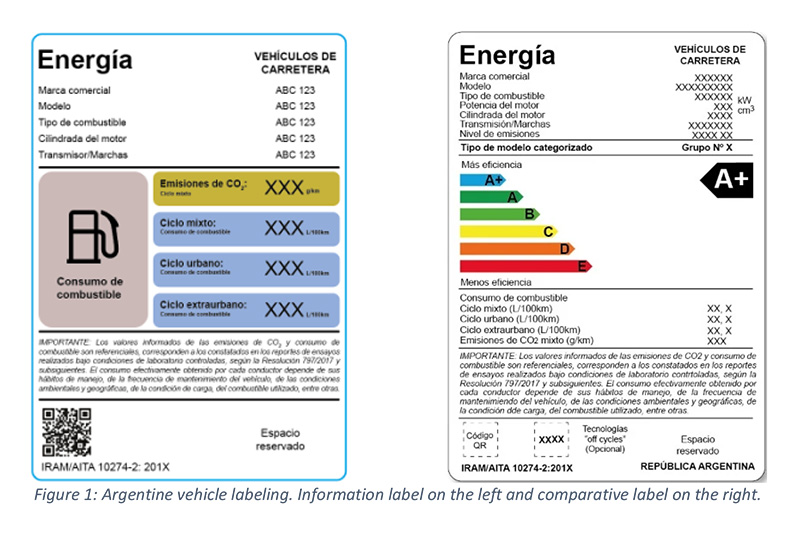

- A recommendation to enforce the already existing rulebook on auto fuel economy labelling. A public information campaign on auto fuel economy was held from September to December 2018 using social media

The policy proposal, tax proposals and all supporting documentation are available from the REC Macedonia website. A summary of the project recommendations are also available here. In April 2019, the Customs Administration submitted the new excise proposal as a part of the ‘New Law on Vehicles’ to the Government and was adopted in June 2019.

The new vehicle tax covers new and used motor vehicles that are imported and / or put into free circulation in the country for the first time. The tax is based on the value of the vehicle and its CO2 emissions (the amount of average CO2 emissions multiplied by the value of 1 gram of carbon dioxide - CO2 for a given category, depending on the fuel type of the vehicle). There are also specific rules for hybrid vehicles (the tax is reduced by 50%), pick-up trucks, and motorcycles (the tax is based on engine volume). It is the first time that vehicle tax has been linked to levels of emissions.