News

Chile’s fuel economy policies accelerating efficiency, supported by GFEI

Chile’s first light-duty (LDV) fuel economy standards, supported by initial research by the Global Fuel Economy Initiative, had a significant impact on the country’s mobility mix and fuel use, according to recent research undertaken by the Centro de Movilidad Sostenible.

Downsize EVs to Accelerate Electric Mobility and Diversify Supply Chains, Says GFEI

Reducing electric car (EV) sizes could accelerate EV adoption, help diversify battery and vehicle manufacturing supply chains, and secure the long-term competitiveness of legacy automakers, according to a new Global Fuel Economy Initiative (GFEI) report, authored by GFEI partner organisation UC Davis.

GFEI Highlights Importance of Integrated Vehicle Energy Efficiency and Electrification Policy at IEA Training Week

The Global Fuel Economy Initiative (GFEI) brought its long-standing commitment to clean, energy-efficient mobility to the 20th Energy Efficiency Policy Training Week hosted by the International Energy Agency (IEA).

Australia finally sets light-duty vehicle CO2 emission standard, supported by GFEI partner work

The adoption of the NVES marks a critical step towards Australia meeting its decarbonisation goals following more than a decade of advocacy from GFEI and its partners, particularly the ICCT.

GFEI Partner report: First global used heavy-duty vehicles (HDVs) market undertaken by UNEP

A new report by GFEI partner UNEP has analysed the flow and scale of the global used heavy-duty vehicles (HDVs) market in a first-of-its-kind analysis.

Parisians challenge SUV supremacy

Parisians have voted to triple parking costs in the city for SUVs to combat air pollution, address climate change and challenge the growing dominance of supersized vehicles on urban streets.

New GFEI partners report on strategies to align global road transport with climate targets

An accelerated transition to electric vehicles is imperative to limit warming-combining with additional strategies can align road transport with well below 2 degrees Celsius says a new report.

Heaviest ever SUVs undermine climate benefits of other vehicle improvements, says GFEI report

The growing market share and huge size of Sport Utility Vehicles (SUVs) are undermining opportunities to mitigate the impact of vehicle improvements even with the growing shift to electric vehicles (EVs).

EPA should work to quickly finalize multipollutant rule for light and medium-duty vehicles

The U.S. Environmental Protection Agency’s (EPA) Office of Transportation and Air Quality has issued a proposed rule to set new multipollutant standards for light and medium-duty vehicles sold from 2027-2032.

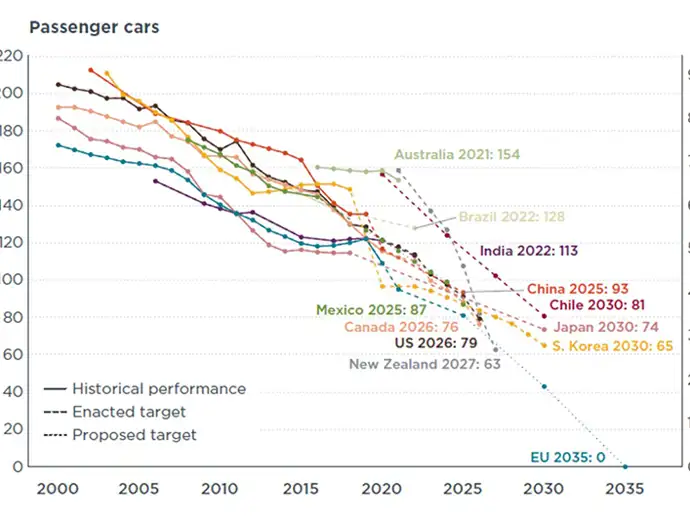

New analysis by GFEI partner ICCT shows Australia’s path to net zero

Transport is the third largest source of greenhouse gas emissions in Australia, and improving vehicle efficiency is vital if the country is to meet its target of achieving net zero by 2050.