Feebates

Feebates are essentially a fee on inefficient technology and a rebate on efficient vehicles. The International Council on Clean Transportation published a report on best practices in designing and implementing fee bate programmes.

According to David L. Greene, Professor of Economics at the University of Tennessee, feebates are a fiscal policy for encouraging car buyers to prefer more efficient, lower emission vehicles and manufacturers to design them.

- FEEs on inefficient vehicles; and

- ReBATEs on efficient vehicles.

A "benchmark" (also known as a pivot point) defines who pays and who receives benefits by setting a level of fuel economy or emissions (e.g. in gCO2/km). A "rate" determines the marginal costs and benefits (usually priced in cost per g/CO2). Depending on the choice of benchmark, feebates can produce revenue, be revenue neutral or be a net subsidy to cleaner, fuel efficient car purchases. A detailed presentation on feebates is available for download here, with examples of feebate systems in France, Norway, Denmark and the US. The ICCT has also published a document on Best Practices for Feebate Program Design and Implementation. According to the ICCT, the important elements of a best practice program are:

- A continuous and linear feebate rate line, without any breaks or discontinuities.

- The pivot point set to make the system self-funding and sustainable, and periodically adjusted to compensate for changing conditions.

- A linear metric, such as CO2 emissions or fuel consumption per unit of distance.

- An attribute adjustment (if one is used) based on vehicle size, not any other metric.

Feebate programs can be extremely useful in supporting the widespread adoption of clean fuel and vehicle technologies. When developed and implemented correctly, government subsidies can speed up the emergence of new, clean technologies and help to ensure economies of scale are reached, so that the next generation of vehicles are more affordable to the general public without government intervention in the market.

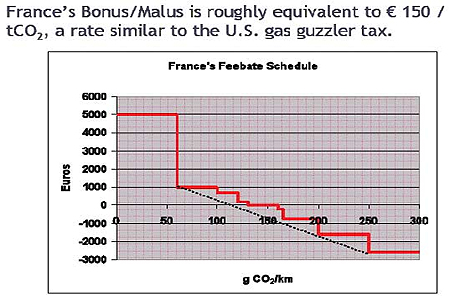

France’s Bonus-Malus program

The Bonus-Malus program, part of France’ comprehensive environmental framework known as the Grenelle Program, paid buyers (in 2009) of cars emitting a maximum of 160 grams of carbon dioxide per km (209 grams per mile) a bonus ranging from $255-6,365 depending on emissions levels. In 2010, the maximum 125 grams per km, and bonuses were reduced.

(Source: David L. Greene, Mexico 2010)

(Source: Transport & Mobility Leuven)

Chile

With the help of the Global Fuel Economy Initiative and the International Council on Clean Transportation, Centro Mario Molina Chile designed and proposed a feebate system for Chile in July 2011. Its adoption is still under review, as of June 2013. The system designed for Chile has the advantage of being fiscally neutral and it produces a change towards cleaner vehicles in all segments of the vehicle fleet, as has been the case, for example, in France with the bonus/malus system, and in Denmark. The feebate is more efficient than the incentives for specific technologies, which have only demonstrated being effective in supporting the development of a new technology, such as hybrid vehicles, but that have had a marginal impact on the vehicle fleet.

The proposed benchmark for Chile is 175 grams of CO2 per kilometer, and it is estimated that the incentive and disincentive system will imply a 5% reduction of CO2 emissions from the total national vehicle fleet in 2014, obtaining a total CO2reduction of 2.15 million tons during the next 5 years. Based largely on the French system (see above) but with a constant CO2 price rather than a step function, the proposed system is available here [English,Spanish] in English and Spanish. Based on the feebate proposal, a Chilean Auto Fuel Economy Label was developed for the national market and adopted in April 2013.

Austria

In Austria, the fuel consumption tax is levied on the purchase price (net) or commercial leasing fee of new passenger cars and motorcycles and on passenger cars and motorcycles not yet registered nationally. Passenger cars (including mini-buses, caravans) & combination cars: 2% x (fuel consumption in liters/100km minus 3 l, respectively minus 2 l for diesel vehicles); the fuel consumption tax must not exceed 16% of the invoice price.

Additionally, a bonus/malus system is included to account for emissions of CO2 (and NOx and PM).

From 2013 on, the bonus-malus for CO2 is:

- For cars with CO2 emissions greater than 160 g/km, the tax is increased by €25 per g/km

over the limit of 150 g/km of CO2 emissions. - On top of that, the tax is increased for vehicles with CO2 emissions greater than 170 g/km

by an additional €25 per g/km CO2 over the limit of 180 g/km CO2 emissions (i.e. €50 per

g/km total for g/km in excess of 180g/km). - On top of that, the tax is increased for vehicles with CO2 emissions greater than 210 g/km

by an additional €25 per g/km CO2 over the limit of 220 g/km CO2 emissions (i.e. €75 per

g/km total for g/km in excess of 220g/km).

Belgium

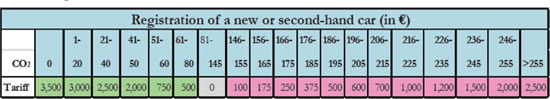

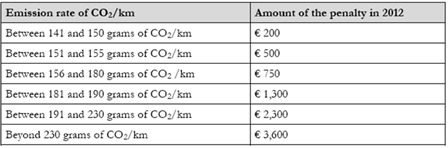

In Belgium, different schemes apply based on the region. In the Walloon region, a CO2 based bonus-malus is added to the standard registration tax (based on fiscal horsepower).

Registration Tax Bonus-Malus based on CO2 (Source: Transport & Mobility Leuven)

Denmark

In Denmark, in addition to a (heavy) tax based on vehicle purchase price, a CO2 based correction is applied. For petrol-powered cars the registration tax is reduced with DKK 4,000 for every km that the car covers more than 16 km/liter fuel (equivalent to 145 g CO2/km). For diesel-powered cars the registration tax is reduced with DKK 4,000 for every km that the car covers more than 18 km/liter fuel (equivalent to 147.2 g CO2/km). For petrol-powered cars the registration tax is raised with DKK 1,000 for every km that the car covers less than 16 km/liter fuel. For diesel-powered cars the registration tax is raised with DKK 1,000 for every kilometer that the car covers less than 18 km/liter fuel.

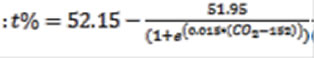

The car registration tax in Finland is a certain % of retail value of the vehicle. For cars and vans, the tax% is calculated according to the following formula:

In practice, the minimum tax % is 5% and the maximum is 50%.

Singapore

In 2013, Singapore implemented the Carbon Emissions-Based Vehicle Scheme (CEVS) to encourage more fuel efficient vehicles. According to the Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam, “over 65 per cent of the cars registered in 2014 qualified for CEVS rebates, while about 5 per cent paid the surcharge.” As such the government has decided to extend the CEVS to 2017, with revised CEVS rebates and surcharges to take effect from 1 July 2015 to 30 June 2017. According to the Land Transportation Authority, “All new cars and imported used cars registered from 1 July with low carbon emissions of less than or equal to 135g carbon emissions per kilometre (CO2/km) will qualify for rebates of between $5,000 and $30,000, offset against the vehicle’s Additional Registration Fee (ARF). Conversely, cars with high carbon emissions equal to or more than 186g CO2/km will incur a registration surcharge of between $5,000 and $30,000. For taxis, which generally clock a higher mileage than cars, the revised CEVS rebate and surcharge for taxi will be increased by 50% to encourage taxi companies to adopt lower carbon emission models for their fleet.”

For more information:

Revised carbon emissions-based vehicle scheme (CEVS) from 1 July 2015 http://www.lta.gov.sg/apps/news/page.aspx?c=2&id=8aa03b88-409f-4852-b2df-09077e101468

Singapore Budget 2015: Carbon Emissions-based Vehicle Scheme extended until June 2017 http://www.businesstimes.com.sg/government-economy/singapore-budget-2015/singapore-budget-2015-carbon-emissions-based-vehicle-scheme