Registration fees

Registration taxes/fees are usually levied upon first registration of the vehicle. This tax is an important source of government revenue and can be used to promote low carbon, fuel efficient vehicles if designed properly. In addition, a periodic, in-use fee may be levied based on CO2 emissions and fuel consumption.

Chile

Vehicle registration fees vary inversely based on vehicle age, with the effect of rewarding older vehicle ownership. The primary challenge to changing this structure is equity-based, as poorer people tend to own older cars. The current vehicle sales tax system does not reflect vehicle efficiency. For more information on Chile, see the Chile case study

Austria

In Austria, the fuel consumption tax is levied on the purchase price (net) or commercial leasing fee of new passenger cars and motorcycles and on passenger cars and motorcycles not yet registered nationally. Passenger cars (including mini-buses, caravans) & combination cars: 2% x (fuel consumption in liters/100km minus 3 l, respectively minus 2 l for diesel vehicles); the fuel consumption tax must not exceed 16% of the invoice price. Additionally, a bonus/malus (or feebate) system is included to account for emissions of CO2 (and NOx and PM).

Belgium

In Belgium, different schemes apply based on the region. In the Flemish region, the tax is calculated as a function of vehicle’s specific CO2 emissions, fuel types, certain fixed prices based on 'Euronorm', and certain age correction factor. This tax grows more than proportionally with time due to an additional emission factor of 4.5g CO2/km per year introduced to the function. The minimum rate is €40, the maximum rate is €10,000. Electric vehicles and PHEVs are exempt from the tax.

Denmark

In Denmark, in addition to a (heavy) tax based on vehicle purchase price, a CO2 based correction is applied. For petrol-powered cars the registration tax is reduced with DKK 4,000 for every km that the car covers more than 16 km/liter fuel (equivalent to 145 g CO2/km). For diesel-powered cars the registration tax is reduced with DKK 4,000 for every km that the car covers more than 18 km/liter fuel (equivalent to 147.2 g CO2/km). For petrol-powered cars the registration tax is raised with DKK 1,000 for every km that the car covers less than 16 km/liter fuel. For diesel-powered cars the registration tax is raised with DKK 1,000 for every kilometer that the car covers less than 18 km/liter fuel.

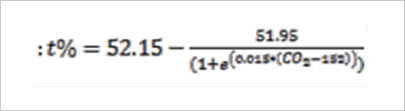

The car registration tax in Finland is a certain % of retail value of the vehicle. For cars and vans, the tax% is calculated according to the following formula:

.

.

In practice, the minimum tax % is 5% and the maximum is 50%.

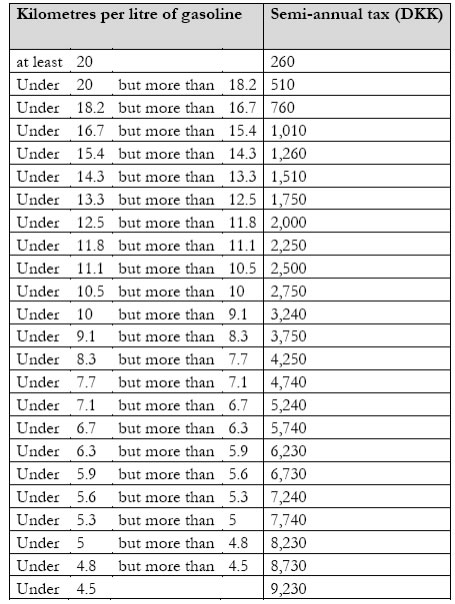

In Denmark the semi-annual tax is based on fuel consumption.

Danish Semi-Annual Fuel Consumption Based Tax (Gasoline) (Source: Transport & Mobility Leuven)

Greece

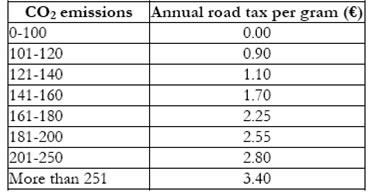

In Greece an annual road tax (€/gram of CO2 emissions) is applied with an more than proportional

increasing rate of tax in function of CO2 emission.

Greek Annual Road Tax (Source: Transport & Mobility Leuven)

Latvia

The Latvian motor tax is only based on specific CO2 emissions as follows:

• up to 120 g per km - LVL 0.3 per 1g per km;

• from 121 to 170 g per km - LVL 1.0 per 1g per km;

• from 171 to 220 g per km - LVL 1.5 per 1g per km;

• from 221 to 250 g per km - LVL 2.5 per 1g per km;

• from 251 to 300 g per km - LVL 3.0 per 1g per km;

• from 301 to 350 g per km - LVL 4.0 per 1g per km;

• over 350 g per km - LVL 5.0 per 1g per km.

Netherlands

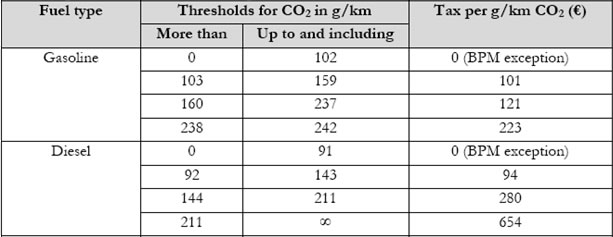

In the Netherlands, part of the registration tax is based on purchase price, the rest on CO2 emissions.

Registration Tax CO2 component in the Netherlands (Source: Transport & Mobility Leuven)

A special regime is in place for low emission vehicles. For gasoline vehicles with emissions of no more than 102g/km, the tax rate is 0 (also the part related to net list price). For diesel vehicles with emissions below 70g/km, the same holds. Diesel vehicles with emissions higher than 70 but not higher than 91g/km only pay the CO2 part of the tax, at a rate of €40.68/(g/km over 70g/km). Diesel cars with Euro 6 engine benefit from a rebate on the BPM of € 1,000 and € 500 in 2012 and 2013 respectively. Zero-emission vehicles, including electric vehicles, are exempt from the tax.

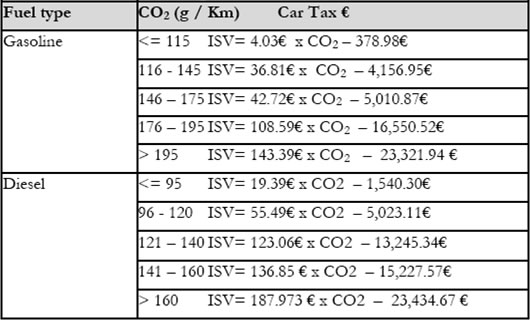

Portugal

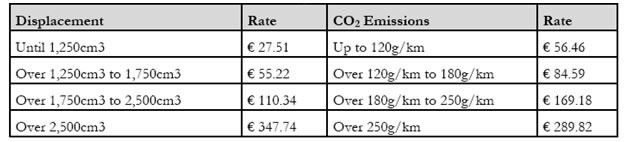

In Portugal, the tax is the sum of 2 parts. One part is based on engine size, the other on CO2 emissions and fuel type:

CO2 Car Tax in Portugal (Source: Transport & Mobility Leuven)

In Portugal, the annual circulation tax is based on engine size (in cc or cm³) and CO2 emissions.

Road Circulation Tax in Portugal (Source: Transport & Mobility Leuven)

The sum of both rates is the tax level, which is then corrected for vehicle age.

Slovenia

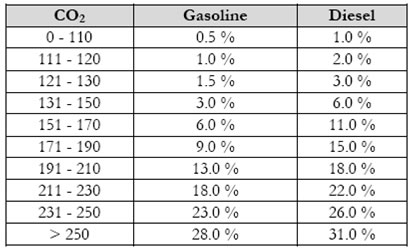

In Slovenia, the tax is a percentage of the price of the vehicle, depending on fuel type and CO2 emissions.

Slovenian Motor Vehicle Tax (Source: Transport & Mobility Leuven)

South Africa

South Africa has established an ad valorem emission tax rate based on CO2 emissions. The tax rate is shown in the table below

| CO2 (g/km) | CO2 Tax Rate |

100 |

0.0% |

110 |

0.0% |

120 |

0.0% |

140 |

1.3% |

160 |

2.7% |

180 |

4.0% |

200 |

5.3% |

220 |

6.7% |

240 |

8.0% |

260 |

9.3% |

280 |

10.7% |

300 |

12.0% |