Mauritius

1.1 Background

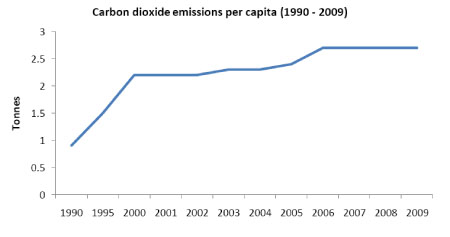

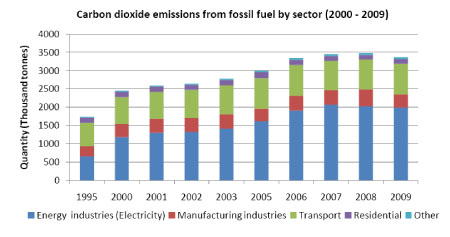

Mauritius depends on imported fuel for close to 83% of its energy needs. The CO2 emissions associated with the burning of fossil fuels are on the rise, with per capita emissions rising steadily due to growing electricity and transportation demand. The combination of electricity use and transportation accounts for more than 85.1% of total CO2 emissions (2006).

Source: Mauritius Environment Outlook Report

.

Source: Mauritius Environment Outlook Report

1.2 Mauritius’s Light-Duty Vehicle Fleet

Mauritius has experienced rapid motorization (including passenger cars and 2-and-3-wheelers) and a growing demand for public transport. Over 45% of the population lives in or around Port Louis, and government plans are underway for a bus rapid transit system for the capital, known as the Mauritius Bus Modernisation Programme to help ease congestion. The government has recently overhauled its taxation of vehicle imports, tying levies and rebates to CO2 emissions (see taxation 3.2 below).

1.3 Status of LDV fleet fuel consumption/CO2 emissions

On a per capita basis, energy-related CO2 emissions have risen sharply over the past three decades (3.6 tons in 2008 from 0.9 tons in 1980). While emissions were still low in comparison with, e.g., South Africa, CO2 emissions in Mauritius were 3.4 million metric tonnes in 2009, with 25% from transportation.

2.0 Regulatory Policies

2.1 National Standard

Mauritius does not have an auto fuel economy standard in place.

2.2 Test Cycles type

The measurement of CO2 emissions from vehicles is required to be certified to have been done in compliance with Regulation No. 101 of the Economic Commission for Europe of the United Nations (UN/ECE) on the measurement of the emission of CO2 and fuel consumption. As part of the certification process, the CO2 and fuel efficiency performance of all passenger vehicles (diesel, petrol, hybrid or full electric) in Europe are assessed according to UN ECE 101. Specified within this standard is a driving cycle which comprises 4 urban start-stop type cycles with one extra-urban cycle intended to represent typical driving patterns for passenger vehicles. This combined cycle is also referred to as the New European Drive Cycle (NEDC).

2.3 Import restrictions

New Vehicles

There is excise duty based on CO2 emission for vehicles, in effect since 13 July 2011. The country’s “CO2 Bill” is downloadable here.

Second Hand

Same as new vehicles, above.

2.4Technology mandates/targets

None

3.0 Fiscal Measures and Economic Instruments

3.1 Fuel Taxes

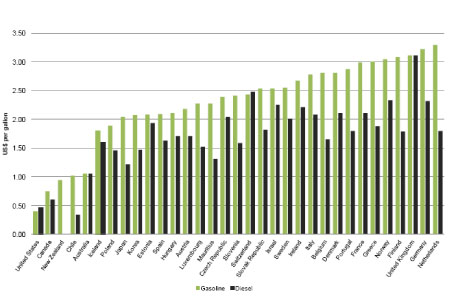

The current excise tax on petrol was increased by 10% in 2011 budget, now at 10.8 rupees (Rs) per liter. However, a variety of other levies (e.g., for contributions to road development and cross subsidies for rice, flour, and LPG) increase the effective tax to Rs 17.8 per liter. Similar levies imply that the effective tax on diesel is Rs 10.25 per liter, even though the excise tax is only Rs 3.3 per liter. These tax levels are broadly in the middle of those for selected OECD countries, but they are much higher than those in the United States and Canada.

Excise Taxes on Motor Fuels, Selected Countries, 2010

Source: OECD, IMF

3.2 Fee-bate

There is a new excise duty/rebate system for Mauritius, based on CO2 emission for vehicles and in effect since 13 July 2011. The country’s “CO2 Bill” is downloadable here. The levy/rebate complements existing fees for cars, and is calculated with the following formula:

A = R x (C – T) where A is the amount of the CO2 levy or CO2 rebate; R is the appropriate rate of the CO2 levy, or the appropriate CO2 rebate per gram per kilometer (km) depending on the categorization of the vehicle according to the law; C is the CO2 gram per km of the motor car, rounded to the nearest whole number; T is the CO2 threshold of 158 grams per km.

A CO2 levy or CO2 rebate has been introduced around a dynamic CO2 threshold currently set at 158 grams per km, which is the average CO2 emission of new motor vehicles classified as motor cars imported into Mauritius in 2010. The CO2 threshold will be reviewed in subsequent years to reflect the average pattern of import of new motor cars. The CO2 levy will be payable if the CO2 gram per Km of a motor car exceeds the CO2 threshold of 158 CO2 grams per Km. The graduated CO2 levy is as follows:

- +Rs 2,000 per gram/km, for Cars from 159 to 190 CO2 grams/km;

- +Rs 3,000 per gram/km, for Cars from 191 to 225 CO2 grams/km;

- +Rs 4,000 per gram/km, for Cars from 226 to 290 CO2 grams/km; and

- +Rs 5,000 per gram/km, for Cars above 290 CO2 grams/km

The amount of CO2 levy payable is the difference between theCO2 gram per Km of the motor car and the CO2 threshold of 158 CO2 grams per Km, multiplied by the CO2 rate. On the other hand, a CO2 rebate is granted when the CO2 gram per Km of a motor car is below the CO2 threshold of 158 CO2 grams per Km. In this case also a graduated rupee rates for CO2 Rebate is proposed as follows-

- A rebate of Rs 3,000 per gramme/km, for Cars with up to 90 CO2 grammes/km; and

- A rebate of Rs 1,000 per gramme/km, for Cars from 91 to 158 CO2 grammes/km.

This amount is deducted from the excise duty payable. The amount of the rebate that can be deducted is limited only up to the amount of excise duty that is payable. The CO2 levy or CO2 rebate system applies only to motor cars at this stage.

3.3 Buy-back

N/A

3.4 Other tax instruments

See information on new CO2 taxation in section 3.2 above.

3.5 Registration fees

Mauritius imposes three taxes on vehicle ownership, all related to engine size, as measured by cylinder capacity in cubic centimeters (cc). There is a one-off excise duty on the car price of 55 percent if the engine capacity is less than 1,600 cc or 100 percent if the engine capacity is greater than 1,600 cc. Mauritius has also now put in place a “CO2 tax” to amend the current vehicle Excise Act to provide, in addition to the excise duty chargeable on motor cars, for a CO2 levy on motor cars or for the granting of a CO2 rebate from the excise duty payable on motor cars (see details in section 3.2 above).

There is also a one-off registration fee for imported vehicles of between Rs 12,500 and Rs 150,000 (US$416–5,000) depending on engine size. Registration fees are paid again (at lower rates, depending on vintage) if vehicles are subsequently sold. And there is an annual road tax of between Rs 3,500 and Rs 13,000, again depending on engine size.3.6 R&D

N/A4.0 Traffic Control Measures

4.1 Priority lanes

N/A4.2 Parking

N/A4.3 Road pricing

The Ministry of Public Infrastructure and Land Transport has considered a number of road pricing, parking and congestion charging proposals5.0 Information

5.1 Labeling

N/A

5.2 Public info

N/A5.3 Industry reporting

The new 2011 Excise Act (see 3.2 above) requires every vehicle importer to provide a CO2 emission certificate issued by the manufacturer of the motor car; in the case of a second-hand motor car, an inspection certificate specified in the Sixth Schedule to the Consumer Protection (Control of Imports) Regulations 1999 is required.

The text above is a summary and synthesis of the following sources:

- Boopen, S. and Sannassee Vinesh. “On the Relationship between Co2 Emissions and Economic Growth: The Mauritian Experience.” University of Mauritius

- Mauritius Environment Outlook Report, http://www.gov.mu/portal/goc/menv/files/MEO/MauritiusEnvironmentOutlookReport.pdf

- Parry, I.W.H. “Reforming the Tax System to Promote Environmental Objectives: An Application to Mauritius.” IMF Working Paper WP/11/124, June 2011.

- Soheea, Z. and D. Surroop. Potential use of biofuels in Mauritian transport sector for cars and dual cars to reduce carbon dioxide emission. University of Mauritius. 2007.

- Sustainable Energy Authority of Ireland, http://www.seai.ie/Grants/Electric_Vehicle_Grant_Scheme/I_am_a_consumer/EV_Range_and_Fuel_Efficiency/

- UNDP. Carbon Finance Mauritius, http://www.undp.org/climatechange/carbon-finance/CDM/mauritius.shtml