Brazil’s Developing Automotive Fuel Economy Policy

1.1 Background

Brazil’s heavy use of flex fuel vehicles and production of ethanol make it both a regional and global frontrunner in cleaner fuels and vehicles. In 2011, the Global Fuel Economy Initiative published a global comparison of auto fuel economy in 21 countries, including Brazil. Average vehicle stock fuel economy went from 7.29 L/100km in 2005 to 7.37 in 2006, an increase of 0.3% (based on the New European Drive Cycle), featuring on the higher, less efficient end of the fuel economy scale on a global level. In order to align itself to best available technology and the GFEI 4L/100 km global target by 2050, there is a lot of room for efficiency gains in the auto sector in Brazil.

Source: Global Fuel Economy Initiative, 2011.

Brazil’s alcohol fuel capacity is founded on its large and efficient sugar industry and favorable climate. New vehicle sales are dominated by flex fuel vehicles (25% Ethanol, 75% petrol). Flex-fuel vehicles account today for almost 90% of total sales (87% in 2008). As a consequence, by 2012, they will probably outnumber vehicles that are solely gasoline powered and in 2030 they will make up around 91% of the total fleet.

1.2 Brazil’s Light-Duty Vehicle Fleet

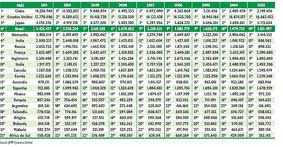

Brazil is one of the top ten automobile manufacturing countries in the world by volume, with a relatively large consumer base. The automobile sales in Brazil are highly dominated by passenger cars and motorcycles. In 2011 some 3.63 million vehicles, including cars, vans, trucks and buses were sold, according to figures released by Fenabrave, Brazil’s National Vehicle Distribution Federation, 3.6 percent up on the 2010 total. Brazil ranks fourth after China, the US and Japan in terms of sales.

Ranking of Vehicle Sales through 2011 (includes cars and light commercial)

Source: Fenabrave.

1.3 Status of LDV fleet fuel consumption/CO2 emissions

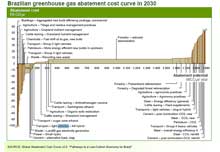

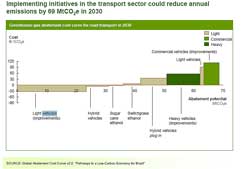

Highway transport emissions, defined as the emissions of the domestic fleet of light (passengers cars), light commercial and heavy vehicles accounts for 6 percent of current Brazilian GHG emissions, behind only forestry and agriculture. In Brazil, this sector benefits heavily from the significant penetration of fuel ethanol, that represents 40 percent of the fuels market for light-duty vehicles (in energy content). Over 85 percent of all light vehicles currently sold in Brazil use flexfuel technology. By 2020, over 80 percent of the Brazilian automobile fleet should be capable of running on pure ethanol, a jump from the current 20 percent, displacing gasoline even further. In spite of this, emissions intensity from the gasoline and diesel used in Brazil can be high due to delays in the investment needed to improve their quality, as stipulated under the Automotive Vehicle Air Pollution Control Program (Proconve). McKinsey projections show accelerated growth of the Brazilian fleet – 115 percent between 2005 and 2030, when it is estimated to reach 49 million vehicles. Much of the projected growth comes from light vehicles.

Source: McKinsey & Co.

Source: McKinsey & Co.

In 2011, the Global Fuel Economy Initiative published a global comparison of auto fuel economy in 21 countries, including Brazil. Average vehicle stock fuel economy went from 7.29 L/100km in 2005 to 7.37 in 2006, an increase of 0.3% (based on the New European Drive Cycle), featuring on the higher, less efficient end of the fuel economy scale on a global level. In order to align itself to best available technology and the GFEI 4L/100 km global target by 2050, there is a lot of room for efficiency gains in the auto sector in Brazil.

2.0 Regulatory Policies

2.1 National Standard

There is not a mandatory fuel economy program.

2.2 Import restrictions

New Vehicles

N/A

Second Hand

Imports of used automobiles into Brazil are not allowed under any circumstances, with special authorization required for the import of used parts. Brazil also has a ban on diesel passenger car imports, but still exports diesel cars to Argentina.

2.3 Technology mandates/targets

Brazil had used some alcohol from sugar cane in vehicles since the 1930s. In the late 1990s Brazil’s auto manufacturers started to use low cost flexible fuel vehicle technology that allowed them to run on any blend of alcohol and gasoline. Motorists bought these flex-fuel vehicles, as they allowed them to take advantage of lower fuel prices as both oil and sugar prices fluctuated. By 2006, about 80% of car sales were flex-fuel. Brazil’s long-term policy of supporting alcohol use in vehicles through difficult years when oil prices were low has paid back in recent years with relatively high oil prices.

Brazil’s alcohol fuel capacity is founded on its large and efficient sugar industry and favorable climate. New vehicle sales are dominated by flex fuel vehicles (25% Ethanol, 75% petrol). Flex-fuel vehicles account today for almost 90% of total sales (87% in 2008). As a consequence, by 2012, they will probably outnumber vehicles that are solely gasoline powered and in 2030 they will make up around 91% of the total fleet.

3.0 Fiscal Measures and Economic Instruments

3.1 Fuel Taxes

3.2 Fee-bate

N/A

3.3 Buy-back

N/A

3.4 Other tax instruments

N/A3.5 Registration fees

Registration fees are handled by the municipality in Brazil, but the registration plates are standardized throughout the country. Brazil adopted its current system in 1990, which uses the form ABC 1234, with a dot between the letters and numbers. A combination given to one vehicle cannot be transferred to another vehicle. Above the combination, there is a metallic band with the state abbreviation (SP = Sao Paulo, RJ = Rio de Janeiro, PR = Parana, AM = Amazonas, etc.) and the name of the municipality..

3.6 R&D

Brazil has invested heavily in sugar cane ethanol and flexi fuel vehicle research since 1975.

4.0 Traffic Control Measures

4.1 Priority lanes

N/A4.2 Parking

N/A

4.3 Road pricing

While not technically road pricing, São Paulo currently has a program that obliges each car to be kept off the street during rush hour one day each week, as well as special bus lanes that help public transport move more easily. It recently announced an additional series of measures to help speed up the flow.

But given the scale of the problem, these measures are timid and ineffective, and the city has rejected a full-scale day without a car program such as the one used in Mexico City. It has also refused to even consider the congestion-charge option that reduced traffic in central London by 30%.

5.0 Information

5.1 Labeling

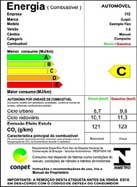

In November 2009, Brazil’s National Institute of Metrology, Standardization and Industrial Quality (Inmetro) implemented a new voluntary labeling system for cars that will inform consumers about the fuel efficiency of the new vehicles they might purchase. Brazil was the only large market country where most car manufacturers did not state fuel consumption.

Categories were defined as subcompact, compact, medium size, large, sports cars, off-road and pick-up. The programme does not impose any fuel mileage goals, yet it counts on consumer pressure to push automakers into improving engine efficiency. Along with all importers (with the honourable exception of Kia), locally-produced brands Citroën, Ford, Mercedes-Benz, Mitsubishi, Nissan, Peugeot, Renault and Toyota have all refused to comply with the initiative.

Fuel economy in kilometres per litre is publicised every October. The label adopted in Brazil is similar to Ireland's (in that case majoring on CO2 output rather than fuel economy).

Brazil’s fuel economy label

5.2 Public info

N/A

5.3 Industry reporting

There is a voluntary fuel economy program using a chassis dynamometer and Brazilian standard NBR-7024, which is similar to the U.S. CVS-75. Brazil also uses the same split as the U.S. – 55% city and 45 % highway. To participate, manufacturers must declare the fuel consumption of at least of 50% of their models which have sales of more than 2.000 units per year.

Test fuels that are used are 22 percent ethanol (E-22), 100 percent ethanol (E-100), and a fuel that can be a mixture of any blend of ethanol and gasoline from 22 percent ethanol to 100 percent ethanol (E-22/E-100). E-22/E-100 is used for Flexible Fuel Vehicles (FFVs) which have the ability to sense the amount of ethanol and change the engine calibration to account for the amount of ethanol.

The text above is a summary and synthesis of the following sources:

- "Advanced Vehicle Technology Action Plan". Major Economics Forum, 2009

- “Brazil: Fuel economy labelling begins.” Just Auto. May 26 2009. http://www.just-auto.com/news/fuel-economy-labelling-begins_id99508.aspx

- "Compilation of Foreign Motor Vehicle Import Requirements." United States Department of Commerce International Trade Administration Office of Aerospace and Automotive Industries, July 2008

- Fenabrave. Brazil’s National Vehicle Distribution Federation.http://www.fenabrave.org.br/principal/home/?sistema=conteudos|conteudo&id_conteudo=2835#conteudo

- International comparison of light-duty vehicle fuel economy and related characteristics. The Global Fuel Economy Initiative. 2011. http://www.globalfueleconomy.org/Documents/Publications/wp5_iea_fuel_Economy_report.pdf

- Source: Joseph, H. "Fuel Economy Program in Brazil." Brazilian Vehicle Manufacturers Association. Available on-line (http://www.fiafoundation.org/Documents/Environment/Fuel%20Economy%20Symposium/3_7_henry_joseph.pdf)

- Pathways to a low carbon economy: Brazil. McKinsey & Co. http://www.mckinsey.com/Client_Service/Sustainability/Latest_thinking/~/media/McKinsey/dotcom/client_service/Sustainabilit

- y/cost%20curve%20PDFs/pathways_low_carbon_economy_brazil.ashx

- "Passenger Vehicles, GHG and Fuel Economy Standards”. International Council on Clean Transport, 2007

- Tavener, Ben. “Brazil’s Record Car Sales Set to Continue.” Rio Times Online. January 10, 2012. http://riotimesonline.com/brazil-news/rio-business/brazils-record-car-sales-set-to-continue/#

- ”The Temas Blog” Accessed 15 June 2010. Available on-line (http://www.temasactuales.com/temasblog/consumer-protection/brazilian-fuel-economy-labels-for-cars/)

- Wills, W., and Emilio Lebre La Rovere. "Light vehicle energy efficiency programs and their impact on Brazilian CO2 emissions.” Energy Policy, Elsevier, 2009