Auto Fuel Economy in Ukraine

1.1 Background

In 2014, the Global Fuel Economy Initiative published an updated global comparison of auto fuel economy in 26 countries, including Ukraine. Average vehicle stock fuel economy went from 7.75 L/100km in 2005 to 7.76 in 2006, 7.0 in 2012 and 6.9 in 2013 (based on the New European Drive Cycle). Yet while auto fuel economy saw steady improvement over the years monitored, in 2012-2013 the auto market in the country shrank by 6.3% due to political and economic unrest. In order to align itself to best available technology and the GFEI 4L/100 km global target by 2050, there is a lot of room for efficiency gains in the auto sector in Ukraine.

Average fuel economy and new vehicle registrations, 2005 to 2013

Source: Global Fuel Economy Initiative, 2014

1.2 Ukrainian Light-Duty Vehicle Fleet

In general, the Ukrainian market favors larger cars. The best selling cars in the first four months of 2012 in Ukraine were cars with an engine volume of 1,600 cc. Second place in popularity were 1.4 liter cars- more than 13% of sales. Among the most popular are diesel 2-liter engines, with more than 30% of the market share.

ZAZ, a local company, is Ukraine’s largest car producer and in second place in sales while Toyota holds first position for sales in the country. In the past, Russia was the main market for the Zaporozhye-made cars. Full sales and production statistics are available from the Ukrainian auto manufacturers association, UkrAutoprom. In Octoober 2014, the Ukrainian car market fell to a 14-year minimum. However, the market is expected to rebound through 2012, with Ukraine a leader in terms of production and sales.

1.3 Status of LDV fleet fuel consumption/CO2 emissions

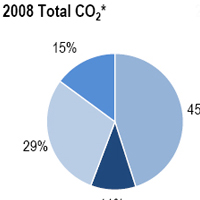

In 2008, the transport sector accounted for about 11% of CO2 emissions in Ukraine, and within that road transport was 72%.

Fuel economy estimates by country and year

* includes emissions from international aviation and international maritime bunkers - there is no internationally agreed allocation mechanism for these and totals here are indicative of the scale of these emissions, not of their national "ownership." Source: International Transport Forum, 2008

2.0 Regulatory Policies

2.1 National Standard

Ukraine does not currently have an auto fuel economy standard in place. At the end of 2009 the EU-Ukraine Association Agenda was adopted. Also, for 2010, a list of priorities for action was jointly agreed by Ukraine and the EU. And transport priorities include the following - implementation of EC acquis in transport legislation through development of new comprehensive national transport strategy of Ukraine. As a result, the sector Ministry and representatives of the EU elaborated the Transport strategy of Ukraine to 2020 – that was adopted on October 20, 2010. The main development goals for the transport sector of Ukraine are:

- modernization of transport system and increase in its efficiency;

- satisfaction of transport needs of national economy and population, improvement of quality and access to transport services;

- guaranteed on-time goods delivery;

- improvement of transport sector governance;

- increase of capacity of transport network;

- higher safety in transport;

- reduction of polluting substances emissions in the air by 30%;

- reduction of energy consumption in transport by 15-20%.

Updates on the strategy can be accessed via the Transport Ukraine website.

2.2 Test cycle type

2.3 Import restrictions

New Vehicles

From January 1, 2013 the import of LDV vehicles below Euro 3 is banned. The national standard for LDV’s is Euro 4 and fuel quality is 200 ppm sulfur for diesel and 500 ppm sulfur in petrol. Euro 5 LDV is planned for January 1, 2016, Euro 6 LDV from January 1, 2018. Excise taxes are lower for vehicles with smaller engine volume and lower CO2 emissions.

According to the Economist Intelligence Unit, in April 2013 Ukraine raised its vehicle import tariffs, between 6.46% to 12.95% of the car’s value on all imported cars except hybrids. Then in September 2013, the Rada (parliament) imposed a "utilisation fee" on imported vehicles, in retaliation for a similar fee imposed by Russia.

Second Hand

N/A

2.4 Technology mandates/targets

N/A3.0 Fiscal Measures and Economic Instruments

3.1 Fuel Taxes

The total tax burden on the pre-tax value of fuel is 195% for petrol and 134 % for diesel (in 2009).

3.2 Fee-bate

N/A

3.3 Buy-back

None

3.4 Other tax instruments

See 3.5 below.

3.5 Registration fees

Ukraine imposed significantly higher registration fees for older vehicles, due to cancellation of import restrictions of vehicles older than 8 years. The registration tax is extremely high for older vehicles thus there are no economic incentives to import old vehicles in Ukraine. A vehicle that is older than 8 years is subject to registration fees 30 times higher than an imported vehicle 8 years or newer. Excise taxes are lower for vehicles with smaller engine volume and lower CO2 emissions. Owners of the vehicles produced in former Soviet Union countries and registered on the territory of Ukraine before 1991 have 50% tax relief on the transport tax.

3.6 R&D

N/A

4.0 Traffic Control Measures

4.1 Priority lanes

N/A4.2 Parking

N/A

4.3 Road pricing

N/A

5.0 Information

5.1 Labeling

None

5.2 Public info

N/A

5.3 Industry reporting

N/A

The text above is a summary and synthesis of the following sources

- GFEI Working Paper 11, International comparison of light-duty vehicle fuel economy and related characteristics. The Global Fuel Economy Initiative. 2014, http://www.fiafoundation.org/connect/publications/gfei-working-paper-11

- International Transport Forum. 2008.http://www.internationaltransportforum.org/jtrc/environment/CO2/Ukraine.pdf

- The Central and Eastern European Automotive Market: Ukraine. Ernst & Young.http://www.ey.com/GL/en/Industries/Automotive/The-Central-and-Eastern-European-automotive-market---Country-profile--Ukraine

- “Transport strategy of Ukraine for the period until 2020.” The Institute for Economic Research and Policy Consulting. 2010". http://www.ier.com.ua/en/publications/comments/archive_2010/?pid=2539

- “Ukrainians Refuse to Buy Fuel Efficient Cars.” Kyiv Weekly. May 30, 2012.http://kyivweekly.com.ua/accent/economy%20news/2012/05/30/150212.html