India's Developing Automotive Fuel Economy Policy

1.2 Background

India is the world's fourth largest economy and fifth largest greenhouse gas (GHG) emitter, accounting for about 5% of global emissions. India's emissions increased 65% between 1990 and 2005 and are projected to grow another 70% by 2020. On a per capita basis, India's emissions are 70% below the world average and 93% below those of the United States. As in many other countries, India has a number of policies that, while not driven by climate concerns, contribute to climate mitigation by reducing or avoiding GHG emissions.

On June 30, 2008, Prime Minister Manmohan Singh released India's first National Action Plan on Climate Change (NAPCC) outlining existing and future policies and programs addressing climate mitigation and adaptation. The plan identifies eight core "national missions" running through 2017 and directs ministries to submit detailed implementation plans to the Prime Minister's Council on Climate Change by December 2008.

Emphasizing the overriding priority of maintaining high economic growth rates to raise living standards, the plan "identifies measures that promote our development objectives while also yielding co-benefits for addressing climate change effectively." It says these national measures would be more successful with assistance from developed countries, and pledges that India's per capita greenhouse gas emissions "will at no point exceed that of developed countries even as we pursue our development objectives."

Ministries with lead responsibility for each of the missions are directed to develop objectives, implementation strategies, timelines, and monitoring and evaluation criteria, to be submitted to the Prime Minister's Council on Climate Change. The Council will also be responsible for periodically reviewing and reporting on each mission's progress. To be able to quantify progress, appropriate indicators and methodologies will be developed to assess both avoided emissions and adaptation benefits.

1.2 India's Light-Duty Vehicle Fleet

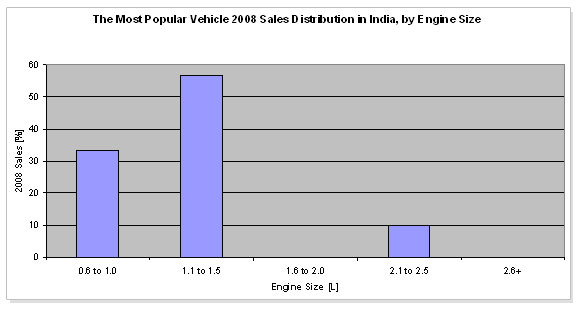

Unlike many other markets, sales in the Indian market are concentrated in a few vehicle models. In fact, just two models (the Suzuki/Maruti Swift and Alto) account for almost one third of total sales and 16 vehicle models account for over 80% of sales. The Indian market is primarily concentrated in the very small classes of cars with small engines; over 30% of the 16 most popular vehicles are powered by engines with less than 1 litre displacement ( a size not sold in North America) and 90% of these vehicles are powered by engines under 1.5 L displacement. The very small engine size within class is also indicative of the relatively low performance of the fleet which enhances fuel economy.

Figure from "International Comparison of Light-duty Vehicle Fuel Economy

and Related Characteristics.

" International Energy Agency Working Paper Series (2010)

Anecdotal information from the Automotive Research Association of India indicates that the 2006 new vehicle fleet average fuel economy from the official Indian test was about 6.3L/100km. International Energy Agency/ICF International (IEA/ICFI) fuel consumption estimates from the sample for 2008 is 5.86 L/100km, but this may be due to sample bias of selecting the most popular vehicles, and the actual estimate for 2008 may be about 5% higher at 6.15 L/100km. However, on the NEDC cycle, the sample base fuel consumption is 8% lower due to the test procedure correction factor, at 5.43 L/100km.

Diesel market share in 2008 was about 20% in cars but nearly 100% in light trucks, with Polk (a U. S. firm which tracks vehicle statistics) data providing a combined estimate of 34.8% diesel penetration. In addition, manual transmissions are dominant although the use of automatic transmissions is increasing in larger vehicles; the smallest vehicles do not typically offer an automatic option.

Technologically, the fleet can be divided into three vehicle types: 1) modern vehicles of European or Japanese design manufactured locally, 2) older models of European or Japanese design still sold in India but phased out in the EC, 3) models of Indian design. New cars of European or Japanese design appear to have virtually the same technology as that offered worldwide and these models including the Suzuki Alto and Swift, the Hyundai i10 and Santro, and the Chevy Spark, account for almost 60% of the market. Many models offer advanced electric power steering, and almost all models in this category offer fuel injection. The only adjustment for the Indian market relative to models sold in the OECD is a modest reduction in compression ratio (by about half a point) to account for the lower octane of Indian gasoline. Older models of foreign origin are sold as price leaders, but their sales are declining rapidly and they represented no more than 10% of the market in 2008. These models like the Maruti 800 and Omni use old design 2-valve carburetted engines, but will likely be phased out with increasingly stringent emission standards.

The third segment includes all models manufactured by Tata Motors and Mahindra who jointly account for about 30% of the market. Mahindra markets small SUVs exclusively and they are mostly diesel powered. The Tata Motors engines are not up to the latest international levels in design with 2 valves/ cylinder and relatively low specific output. Many of Mahindra's SUVs still use a naturally aspirated diesel although a modern turbocharged common rail diesel has been introduced in their new Scorpio model. This segment may fall between the first two segments in their technological sophistication.

Use of air-conditioning has also been rising rapidly and anecdotal information suggests that penetration is over 50% in new cars. Their use with small engines results in very significant loss in fuel economy, but no information is available on the sophistication of the air-conditioning equipment. Air conditioner use will also not be reflected in any official fuel economy test data since the accessories are turned off for the test. In addition, IEA/ICFI found that some low cost models still use bias ply tires as radial tires are not yet widely available in India in all sizes.

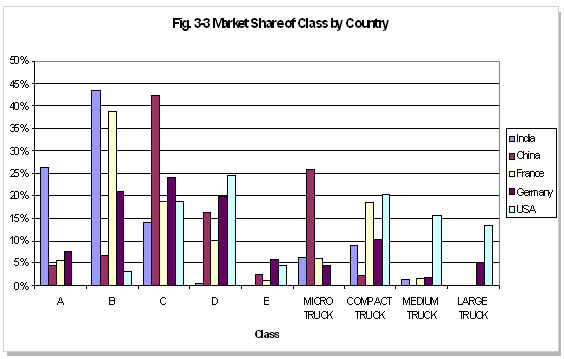

The Indian market has been growing at about 10 percent a year except in the 2008 - 2009 period and the IEA/ICFI expect growth to resume next year at the 10 percent rate and continue at about this rate for the 2010 to 2020 period. India has one of the smallest vehicle size mixes of any major country, but in the 2002 to 2007 period, the sizes mix trended away from the entry level vehicle size classes to larger classes. For example, car sizes are judged from A-E with A being the smallest and E being the largest. As can be seen in the graph, India has a large share of A class cars, while in the U.S., none of these are sold.

Figure from "International Comparison of Light-duty Vehicle Fuel

Economy and Related Characteristics." International Energy Agency Working Paper Series (2010)

However, the introduction of the Tata Nano suggests major growth in the very small vehicle market. Other manufacturers including market leader Maruti and Ford are planning products in this segment that could be introduced in the 2012 to 2014 time frame. It is anticipated that the A class market could account for 1.2 million of the 2.8 million vehicle market implied by a 10 percent growth rate from 2009 to 2015, or a 43 percent market share, up from about 26 percent in 2008. This is an unusual development since the typical pattern is for vehicle size to increase.

From the perspective of fuel consumption, these new models are quite significant due to their potential high fuel efficiency. The Tata Nano has been certified at 4.24 L/100km (4.55 L/100km in the city and 3.85 L/ 100km highway) which is a consumption rate 28% lower than the 2008 estimated average of 5.86 L/100 km. Even if fuel efficiency improvements in other classes are minimal, the fleet average fuel consumption will be reduced to about 4.9 L/100km from the current 5.86 L/100km estimated for 2008, a 16.4% reduction. Larger reductions could occur if the other classes also aggressively adopt technology to compete with the low priced (and low profit) cars. As in China, the IEA/ICFI do not anticipate widespread use of downsized GDI - turbo engine in India since the baseline engine size is already very small and the turbo is not well suited to India's low speed driving conditions. Hybrid technology appears to be too expensive for this market at the current time but could be adopted in the post-2020 time frame.

Vehicle average size, short daily driving distances and the weather favour the EV, but the country has a poor electricity supply situation with frequent power cuts in many parts of the country. Hence, until the power supply situation improves, any significant move to EV technology is likely to be counter-productive.

1.3 Status of LDV fleet fuel consumption/CO2 emissions

Two significant unknowns for the Indian market are the state of fuel economy regulations and the future of the light duty diesel. Technology-forcing standards in India will need to take into account the existing high efficiency of the Indian fleet and the popularity of small, relatively efficient vehicles.

In addition, large subsidies for diesel fuel to assist commercial trucking has made light duty diesels popular and current market share already exceeds 20 percent and may increase more in the B-class and larger segments. Due to air quality concerns, it is possible that light duty diesel vehicles may be taxed extra to offset the existing diesel fuel subsidy. This could reduce diesel penetration, but the effect on average fuel consumption will be to increase it by a maximum of 4 to 5 % relative to the 2008 baseline if diesel penetration goes to zero, which is not likely.

In summary, the IEA expects the average fuel consumption of the vehicle fleet to drop by at least 16 percent in 2015 relative to 2008, driven largely by the anticipated popularity of very cheap, very small cars (e.g. the Nano). However, this is not a done deal - strong policies will need to be put in place in order to ensure continued, sustained improvements and no backsliding. By 2020, the net reduction in fuel consumption could be around 20% to 22 % or more due to both the mix shift and modest technology improvements (~5%) to all vehicles.

2.0 Regulatory Policies

2.1 National Standard

In 1991, India embarked on a formal emission control regime, resulting in a gap in comparison with technologies available in the United States or Europe. India is behind Euro norms by a few years, however, emission norms are being aligned with Euro standards and vehicular technology is being accordingly updated.

2.2 Test cycle type

India also uses the NEDC but modifies it for Indian conditions by limiting the maximum cycle speed to 90km/h. There are also some other procedural changes to the test protocol that make the Indian test somewhat different. No specific study is available to estimate the effect of the Indian procedure relative to the NEDC procedure. As a result, IEA/ICFI compared the reported fuel economy of 'identical' vehicles for Europe and India.

2.3 Import restrictions

New Vehicles

The new vehicles are subject to follow certain rules as specified by the Indian Motor Vehicles Act 1988. The imported cars too are required to adhere to the same rules. As per the conditions laid down by the Act, new cars should include: A speedometer indicating speed in Km/h, have a right hand steering and controls, have photometry of headlamps to suit keep left traffic and should be imported from the country of manufacture.

Second Hand

For a second hand or used cars being imported into the country, it should not have been sold, leased or used in India prior to being imported to India. The second hand car should have been registered for use in any foreign country. The second hand or pre-owned car being imported to India is also subject to certain conditions as laid down by the Motor Vehicles Act, 1988. The conditions are: the second hand vehicle shall not be older than three years from the date of manufacturer; it should have a right hand steering and controls; have a speedometer indicating speed in Km/h and also headlamps suited to Indian conditions. The imports of these cars are also through the same ports specified for new cars. It is specified that the second hand car imported into India should have a minimum roadworthiness for a period of 5 years from the date of being brought into the country. Hence, it is required that the importer shall submit a declaration indicating the period of the roadworthiness. It should be supported by a certificate issued by any of the testing agencies which are notified by the Central Government.

After being brought into the country, the second hand car should be submitted for testing to vehicle research and development establishment, Ahmednagar, of the ministry of Defence or the Automotive Research Association of India, Pune or Central Farm and Machinery Training and Testing Institute, Budni Madhya Pradesh or any other agency as specified by the Central Government.

- Vehicles have to be under 3 years.

- Vehicles have to be Right Hand Drive.

- Importers can do import clearance only at Mumbai Port.

- Vehicles need to be inspected by Japan Auto Appraisal Institute (JAAI).

2.4 Technology mandates/targets

N/A

3.0 Fiscal Measures and Economic Instruments

3.1 Fuel Taxes

According to the Ministry of Petroleum and Natural Gas of India (2005), fuel taxes in India are $0.47/L for petrol and $0.17/L for diesel. The price of fuels is $0.71/L for diesel, and $0.97/L for petrol. This makes petrol around the same price as that found in Canada ($1.01/L), and diesel slightly cheaper than the US ($0.77/L). Compared to many developed countries, fuel taxes in India remain relatively low, which suggests that there is room for an increase in fuel taxes to correspond with an increase in vehicle ownership over the long-term period.

However, the government has decided (in 2010) to de-control petrol prices and increase the price of other fuels, such as diesel, kerosene and cooking gas to help oil exploring and marketing companies, which have been loosing revenue by selling fuels at discounted rates. Currently petrol prices are pegged at $65-70 dollars a barrel. Although prices may increase in the short run, according to the government's chief economy advisor, in the long run prices will decrease, and energy use will become more efficient. This will also affect the auto industry in India, which will be under increasing pressure to sell more fuel efficient vehicles.

3.2 Fee-bate

N/A3.3 Buy-back

N/A3.4 Other tax instruments

The central excise duty has been crafted to give an advantage to the small cars in India for fuel savings. The current rate of 12% excise on small cars and 24% on bigger cars and SUVs has been maintained in the budget. This is the only measure that is linked to addressing the need for fuel efficiency of vehicles in India.

However, the flaw in the current tax scheme is that the small car segment has been defined as a car of length not exceeding 4,000 mm and with an engine capacity not exceeding 1,200 cc for petrol cars and 1,500 cc for diesel cars. The more relaxed limit for diesel cars has brought within net a large number of mid-segment diesel cars to qualify for the tax cut. This has created an incentive for small diesel cars when clean diesel fuel and technologies are not available in India. This can have adverse public health consequences.

The Air Ambience Fund has been created by the Finance department by an office memorandum dated March 27, 2008. An Air Ambience Fund account has been opened in the Delhi Pollution Control Committee (DPCC).

The first scheme that is to be funded from the Air Ambience Fund is the program to give a subsidy to battery-operated vehicles. This will help to promote zero emissions vehicles in the city. The Delhi government has decided to extend relief to the tune of 30 per cent of costs to those opting for battery-operated vehicles. Prospective buyers of these vehicles will get 15 per cent subsidy and 12.5 per cent VAT reimbursement. In addition, the registration charge and one-time road tax levied at the time of registration will also get reimbursed. This scheme started in 2008 will be funded entirely under the Air Ambience Fund. This is expected to encourage expansion of the zero emissions vehicles in the city.

3.5 Registration fees

N/A3.6 R&D

While the Tata Nano has garnered a lot of attention, the Indian car market is thriving with plans and projects focused on low-cost, small cars. Bajaj, a leading two-wheeler manufacturer, and Renault have a joint project to create an ultra-low cost car that aims to beat the fuel economy of the Nano by a significant margin. REVA is an Indian electric vehicle manufacturer who is licensing its technology to GM to market an electric version of its Spark model in late 2010. As of April 2010, Toyota has launched its Prius hybrid car in the country, although the demand for this car is expected to remain very low due to high import duties. And several sport-utility vehicles, especially those manufactured by Mahindra and Mahindra, are deploying start-stop systems. However, in addition to cost and efficiency concerns, manufacturers will also have to address safety standards for this new generation of ultra-light and compact cars.

Despite an increased penetration into developing country markets, electric vehicles still serious hurdles to overcome, if they are to gain widespread adoption. The most significant hurdle is price of electric vehicles, with the Chevy Volt expected to cost upwards of $40,000. Another serious hurdle is basic electricity supply, with many developing countries experiencing widespread power outages, or inconsistent supply. Many would prefer to use the minimal electricity available to power homes and hospitals, than to direct it towards an electric vehicle charging system.

4.0 Traffic Control Measures

4.1Priority lanes

N/A

4.2 Parking

N/A

4.3 Road pricing

N/A

5.0 Information

5.1 Labeling

From the start of 2010, the Indian Ministry of Power announced that new cars sold in India will receive a star rating of one to five stars for fuel efficiency. Initially, the label will be voluntary, but after 2011 labeling will become mandatory under a strict grading system. Once the labeling becomes mandatory, the one star would become the minimum energy performance standard that all vehicles, except for low volume cars, will have to meet. The label will indicate fuel economy of the new car, and tell the buyer how the car performs when compared to other models in the same category, which will be based on the vehicle's weight. Click here to see example of the Indian label.

5.2 Public info

N/A

5.3 Industry reporting

Indian fuel economy data as measured on the official test was kept confidential until April 2009, but was released by the manufacturers in May. The Society of Indian Automobile Manufacturers (SIAM) contains information on trade, environment, safety, and technology in the Indian automotive industry. The Automotive Research Association of India (ARAI) is a research association providing technical expertise and assistance in R&D, testing, certification, and works with government ministries and the automotive industry to harmonize the Indian automotive standards to global standards.

The text above is a summary and synthesis of the following sources:

- "AECC Newsletter - January - February 2010." Association for Emissions Control by Catalyst, 2010. Accessed 22 March 2010. Available on-line (http://www.aecc.eu/en/Newsletter/Newsletter.html).

- "Bajaj small car aims at 30 km per litre." Rediff Business, 5 May 2010. Accessed 14 June 2010. Available on-line (http://business.rediff.com/slide-show/2010/may/05/slide-show-1-auto-bajaj-small-car-aims-at-mileage-of-30-km-per-litre.htm).

- "Car Import Guidelines in India". Articlebase, 16 June 2009. Accessed 14 June 2010. Available on-line (http://www.articlesbase.com/cars-articles/car-import-guidelines-in-india-974927.html).

- "Central Board of Excise and Customs". Government of India, Ministry of Finance, Department of Revenue. Available on-line (http://www.cbec.gov.in/cae1-english.htm).

- Chang, Richard S. "Tata Nano: The World's Cheapest Car." Accessed 14 June 2010. Available on-line (http://wheels.blogs.nytimes.com/2008/01/10/tata-nano-the-worlds-cheapest-car/).

- "Comparison of Total & ex-Tax Price of Petroleum and Diesel with Developed Countries", Ministry of Petroleum and Natural Gas, Government of India, 2005. Accessed 14 June, 2010.

- CSE India, Anumita Roychowdry. Personal Interview with Greg Dana. February 2010

- "Emission Norms." Society of Indian Automobile Manufacturers, 2005. Accessed 11 June 2010. Available at http://www.siamindia.com/scripts/emission-standards.aspx.

- Excerpts from IEA paper - International Comparison of Light-duty Vehicle Fuel Economy and Related Characteristics - Draft January 2010

- "International Comparison of Light-duty Vehicle Fuel Economy and Related Characteristics." International Energy Agency Working Paper Series, 2010: 1-70.

- "India's National Action Plan on Climate Change." Government of India, Prime Minister's Council on Climate Change, 2008. Available on-line (http://www.pewclimate.org/international/country-policies/india-climate-plan-summary/06-2008).

- Lakshman, N. "Made in India: The $12,000 Electric Car." Time Magazine, 21 July 2009. Accessed 14 June 2010. Available on-line (http://www.time.com/time/world/article/0,8599,1911869,00.html).

- "Move Over Nano, Bajaj car costs Rs 110,000." Rediff Business, 03 May 2010. Accessed 14 June, 2010. Available on-line (http://business.rediff.com/report/2010/may/03/auto-move-over-nano-bajaj-car-to-cost-rs-110000.htm)

- "REVA Electric Car Company." Wikipedia, Accessed 14 June 2010. Available on-line (http://en.wikipedia.org/wiki/REVA_Electric_Car_Company).

- Sharma, S. And Nair, V."GM May Scrap Indian Electric-Car Tie-Up as Mahindra Buys Partner." Bloomberg Businessweek, 26 May 2010. Accessed 14 June 2010. Available at (http://www.businessweek.com/news/2010-05-26/gm-may-scrap-india-electric-car-tie-up-as-mahindra-buys-partner.html).

- Tata Motors Ltd., Prospects of Hybrid Electric Vehicles (HEVs) and Alternate Fuel Vehicles in India.

- "Tata Nano." Wikipedia. Accessed 14 June 2010. Available on-line (http://en.wikipedia.org/wiki/Tata_Nano#Diesel)