Republic of Korea Developing Automotive Fuel Economy Policy

1.1 Background

South Korea is one of the few countries in the world (including the US, Japan, Canada, Australia, China, India, and the European Union) to have adopted mandatory auto fuel economy standards. As of 2011, the country was one of the most heavily motorized, rated 42nd in terms of vehicle ownership with 379 vehicles per 100 people. In addition to being a major consumer of cars, the country is also a manufacturer – in 2010 South Korea produced 5% of the world’s new cars.

1.2 South Korea Light-Duty Vehicle Fleet

See above section 1.1

1.3 Status of LDV fleet fuel consumption/CO2 emissions

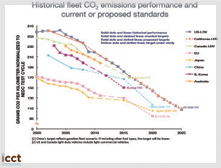

The overall efficiency of Korea’s vehicle fleet has steadily improved since data became available about a decade ago. All new vehicles are required to reach 17 km/L or 140 gCO2e/km (equivalent to 150 gCO2/km under the New European Drive Cycle) by model year 2015.

Historical Fleet CO2 emissions perfomance and current or proposed standards.

2.0 Regulatory Policies

2.1 National Standard

Fuel efficiency targets have been in place in Korea since the 1990s. An average fuel economy program and fuel economy rating identification of motor vehicles was introduced in 2005. Fuel economy standards were enacted in 2006 for domestically-produced cars, 2009 for imported cars with sales of less than 10,000. Imported cars with sales of more than 10,000 had to meet US CAFÉ Standards. Fuel economy standards in the Republic of Korea are based on an engine size classification system. The reference average fuel economy standards were 12.4 km/L for vehicles with 1500cc engines or less, and 9.6 km/L for engines greater than 1500cc displacement. New passenger cars sold within the country in 2008 ran an average of 11.47 kilometers per liter of fuel (27 mpg US, 8.7 L/100km)—up from 11.04 km/L (26 mpg US, 9.1 L/100km) recorded in 2007.

In July 2009, the Republic of Korea announced plans for a combined fuel economy and GHG emissions target of 17 km/L or 140 gCO2e/km (equivalent to 150 gCO2/km under the New European Drive Cycle) respectively for model year 2015, weight-based and will use US CAFE combined cycle for testing purposes. The standard will take a phased approach, with 1 30% compliance rate expected by manufacturer in 2012, 60% in 2013, 80% in 2014 and 100% in 2015.

2.2 Test cycle type

The Republic of Korea is following testing methods that are similar to US CAFE procedures.

2.3 Import restrictions

New Vehicles

Imports must meet several national safety and environmental standards, including fuel economy (see section 2.1 above).

Second Hand

N/A

2.4 Technology mandates/targets

In 2011 the South Korean government announced that it will offer up to Won 4.2m (US$3,590) in tax incentives to any buyer of a new electric vehicle. Under the scheme, which came into force on 1 December 2011, a buyer of a new EV will receive a 5% discount from the country’s special consumption tax and a 7% exemption from purchase and registration taxes. The South Korea market does not yet feature compact EVs, but GM has developed the electric Chevrolet Spark at GM Daewoo, and Hyundai’s BlueOn is due to be launched early in 2012. An industry-led consortium is reportedly developing a medium-size battery-electric commercial vehicle for launch in 2014. Along with its tax incentives, the government also announced standard formats to measure the fuel efficiency of electric vehicles, under which manufacturers will be required to state the car's maximum speed and maximum distance of travel per full charge.

3.0 Fiscal Measures and Economic Instruments

3.1 Fuel Taxes

N/A

3.2 Fee-bate

N/A

3.3 Buy-back

N/A

3.4 Other tax instruments

The taxes described below are calculated cumulatively, but several are applied as percentages of other automotive taxes. The Korean Government imposes eight different taxes on passenger cars, which are assessed on the C.I.F. value of the vehicle plus the eight percent tariff. Three of the taxes are based on engine displacement. The Korean engine displacement taxes are currently applied such that a disproportionate financial burden falls on vehicles with larger engines (over 2,000cc).

Taxes Levied at the Purchase Stage: At the purchase stage, the following three taxes are levied: 1) special consumption tax (a percentage of the C.I.F. value of the vehicle plus duty, based on engine displacement), 2) education tax (30 percent of the special excise tax), and 3) a 10 percent value added tax (VAT), calculated on the vehicle value inclusive of the special consumption tax and the education tax. The special consumption tax is based on engine displacement, with the following rates:

- 0-800 cc zero percent

- 801-2000 cc five percent

- 2001cc and over 10 percent

Taxes Levied at the Ownership Stage: The Korean Government also assesses two taxes at the ownership stage: 1) annual vehicle tax (based on engine size), 2) annual vehicle education tax (30 percent of the annual vehicle tax). The annual vehicle tax is based on engine displacement with the following rates

- 800cc and below 80 Won/cc

- 801cc-1,000cc 100 Won/cc

- 1,001cc-1,500cc 140 Won/cc

- 1,501cc-2,000cc 200 Won/cc

- over 2,001cc 220 Won/cc

3.5 Registration fees

At the registration stage, the Korean Government levies the following three taxes: 1) registration tax (five percent of the retail price before VAT), 2) acquisition tax (2% of the retail price before VAT) and 3) subway bond (based on engine displacement). The subway bond is another tax based on engine displacement. The engine displacement categories and rates are calculated as a percentage of the retail price as follows:

- Below 1000cc four percent

- 1001cc-1600cc nine percent

- 1,601cc-2000cc 12 percent

- 2,001 and over 20 percent

Sport utility vehicles: five percent (regardless of engine size)

For additional taxation, see section 3.4 above.3.6 R&D

N/A

4.0 Traffic Control Measures

4.1 Priority lanes

N/A

4.2 Parking

N/A

4.3 Road pricing

N/A

5.0 Information

5.1 Labeling

A labelling scheme was introduced in 2005, whereby all cars are required to show a label indicating the cars fuel economy ranking (1-5) and its fuel economy (km/l).

5.2 Public info

N/A

5.3 Industry reporting

N/A

The text above is a summary and synthesis of the following sources:

- Compilation of Foreign Motor Vehicle Import Requirements. United States Department of Commerce International Trade Administration Office of Transportation and Machinery. 2011. http://trade.gov/static/autos_report_tradebarriers2011.pdf

- Global Overview on Fuel Efficiency and Motor Vehicle Emission Standards: Policy Options and Perspectives for International Cooperation. United Nations Department of Economic and Social Affairs. 2011. http://www.un.org/esa/dsd/resources/res_pdfs/csd-19/Background-paper3-transport.pdf

- ICCT Bulletins “Global passenger vehicle fuel economy and GHG emissions standards: May 2012 Update” http://www.theicct.org/global-passenger-vehicle-standards-update

- Review of International Policies for Vehicle Fuel Efficiency. International Energy Agency, 2008: 22. http://www.iea.org/papers/2008/Vehicle_Fuel.pdf

- ‘South Korea to Boost Vehicle Fuel Economy Standards.” 2009. http://www.greencarcongress.com/2009/06/korea-20090604.html ‘South Korea: Government confirms EV incentives.’ 2011 http://www.automotiveworld.com/news/oems-and-markets/89849-south-korea-government-confirms-ev-incentives?highlight=South+Korea

- Vehicle fuel economy standards in the ASEAN: Need for harmonized approach. Clean Air Initiative for Asian Cities Center (CAI-Asia Center). http://www.uncrd.or.jp/env/5th-regional-est-forum/doc/10_Breakout%20Session2-D/BS2-D-1_CAI_Asia-Bert.pdf

- Wikipedia: http://en.wikipedia.org/wiki/List_of_countries_by_vehicles_per_capita

- Worldwide Emissions Standards: 2011/2012. Delphi. http://delphi.com/pdf/emissions/Delphi-Passenger-Car-Light-Duty-Truck-Emissions-Brochure-2011-2012.pdf