The European Union Automotive Fuel Economy Policy

1.1 Background

A decade ago, the European Union entered into a series of voluntary agreements with the associations of automobile manufacturers that sell vehicles in the European market to reduce CO2 tailpipe emissions. These agreements applied to each manufacturer’s new vehicle fleet, and set an industry-wide target of 140 grams CO2 per kilometre (6 l/100km or 39 mpg). The original agreement with the European Car Manufacturers Association (ACEA) had an initial compliance date of 2008, while the Asian manufacturers (represented by South Korean and Japanese associations, KAMA and JAMA) were given until 2009 to comply.

However, automakers did not meet the voluntary target and the European Commission has now set mandatory targets. In June 2007, the Council of Environment Ministers formally adopted a resolution to approve the shift to mandatory standards and an integrated approach to achieve 120 g/km (5.2 l/100km or 45.6 mpg), with carmakers achieving 130 g/km (5.6 l/100km or 42 mpg) through technical improvements and the remaining 10 g/km coming from complementary measures. The full EC strategy to reduce CO2 emissions from cars and vans is available online, as is the regulation.

1.2 The EU Light-Duty Vehicle Fleet

Europe is expected to lead the world in fuel economy through at least 2015 if not longer, primarily due to the expanded use of efficient diesel engines in its light-duty vehicle fleet. The reasons for strong diesel demand are mainly tax incentives (with lower taxes on diesel fuel and lower import taxes on diesel cars in some EU countries), high fuel prices and the superior driving capabilities of diesel engines. Diesel fuel contains about 10 percent more carbon and more energy than gasoline. As a result, the fuel economy of diesel vehicles is augmented by both the energy efficiency and the greater energy content of the fuel when measured using miles per gallon. However, when considered under a GHG-basis, the higher carbon content of the fuel is taken into account and offsets the fuel-related improvement found on a mpg-basis.

New research by the European Environment Agency (EEA) show that new passenger cars registered in the EU in 2010 are emitting 3.7 % less CO2 per kilometre travelled than new cars from 2009. In 2010, approximately 13000 flex fuel vehicles (vehicles working with several types of fuel such as ethanol and gasoline) and 700 electric vehicles were registered in the EU.

Evolution of CO2 emissions for new passenger cars by fuel (EU27)

.jpg)

Source: EEA. AFV: alternative fuel vehicles; gCO2/km: grams CO2 per kilometre.

1.3 Status of LDV fleet fuel consumption/CO2 emissions

The transport sector is the second largest source of CO2 emissions in the EU. Road transport alone accounted for about one fifth of total EU CO2 emissions in 2009 and its emissions increased by 23% between 1990 and 2009. Road transport is one of the few sectors where emissions are still rising rapidly: between 1990 and 2008 emissions from road transport increased by 26%. This increase acted as a brake on the EU's progress in cutting overall emissions of greenhouse gases, which fell by 7%. Passenger cars alone are responsible for around 12% of EU CO2 emissions. Although there have been significant improvements over recent years in vehicle technology – particularly in fuel efficiency, which translates into lower CO2 emissions – these have not been enough to neutralise the effect of increases in traffic and vehicle size.

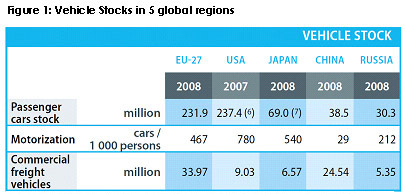

Vehicle Stocks in 5 global regions

Source: EU Energy and Transport in Figures Pocketbook 2010, European Union, 2010: 105. Available on-line (http://ec.europa.eu/energy/publications/statistics/statistics_en.htm.)

2.0 Regulatory Policies

2.1 National Standard

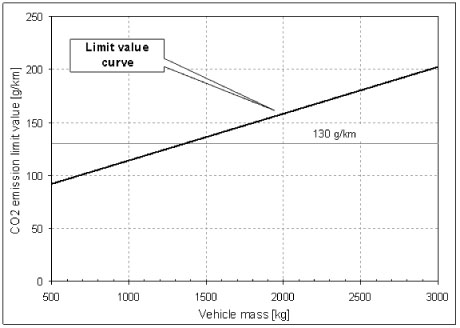

On April 23, 2009, the European Parliament and the Council approved regulations setting a target of 130 g/km (5.6 l/100km or 42 mpg) for the average emissions of new cars to be phased-in by 2015. A longer-term target of 95 g/km (4.1 l/100km or 57.6 mpg) has been established for 2020; the modalities for reaching this target and the aspects of its implementation will have to be defined in a review to be completed no later than the beginning of 2013. The emission targets have to be met by each car manufacturer. Each manufacturer gets an individual annual target based on the average mass of all its new cars registered in the EU in a given year. As of 2012, manufacturers must ensure that 65% of the new cars registered in the EU each year have average emissions that are below their respective targets. The percentage rises to 75% in 2013, 80% in 2014 and 100% in 2015. Indicative emissions are established for each car according to its mass on the basis of the emissions limit value curve in Annex I in the Regulation. The limit value curve is set in such a way that a fleet average of 130 grams of CO2 per km is achieved for the EU as a whole.

Only the fleet average is regulated, so manufacturers will still be able to make vehicles with emissions above their indicative targets if these are offset by other vehicles which are below their indicative targets. In order to comply with the regulation, a manufacturer will have to ensure that the overall sales-weighted average of all its new cars does not exceed the limit value curve. The curve for passenger cars is also set in such a way that, compared to today, emissions from heavier cars will have to be reduced by more than those from lighter cars.

Source: EC

The precise formula for the EC limit value curve is:

Permitted specific emissions of CO2 = 130 + a × (M – M0)

Where: M = mass in kg, M0 = 1289.0, a = 0.0457

The Commission has encouraged the member countries of the EU to pursue taxation policies to promote the purchase of fuel efficient vehicles throughout the EU. Taxes differentiated over the whole range of cars on the market, so as to gradually induce a switch towards relatively less emitting cars, would be an efficient way to reduce compliance costs for manufacturers. The law also sets a target of 95 g/km (4.1 l/100km or 57.6 mpg) for the vehicle fleet in 2020 and later model years. The aspects of its implementation including the excess emissions premium will have to be defined in a review to be completed no later than the beginning of 2013.

2.2 Import restrictions

New Vehicles

Vehicles brought into the EU must comply with the EU's type-approval directive (EU Council Directive 92/53). Vehicles with EU type-approval can be marketed anywhere in the Community. Therefore, a vehicle need only receive type-approval certification in one EU country to be accepted in all other member countries. To receive type-approval, products may either be brought to a testing facility or manufacturers may opt to maintain their own approved, on-site equipment.

Second Hand

The EU's single internal market became official on January 1, 1993. Part of this effort includes the initiative to remove technical barriers to the free movement of products within the EU.

2.3 Technology mandates/targets

With the CO2 95 g/km target for 2020, European manufacturers must continue to advance technology across all fuel types to achieve this level of CO2 emissions. The industry is pursuing electric motors, hybrid drive trains, hydrogen fuelled vehicles and biofuels. There is no technology mandate, per se, in Europe, but manufacturers are pursuing various technology options to meet targets.

3.0 Fiscal Measures and Economic Instruments

3.1 Fuel Taxes

Fuel taxes vary from country to country in the EU. Following are a few examples of the taxes found in some of the EU countries:

- Fuel taxes in Germany are €0.4704 per litre for ultra-low sulphur Diesel and €0.6545 per litre for conventional unleaded petrol, plus Value Added Tax (19%) on the fuel itself and the Fuel Tax. That adds up to prices of €1.03 per litre for ultra-low sulphur Diesel and €1.22 per litre (approximately USD 6.28 per US gallon) for unleaded petrol (March 2009).

- The sale of fuels in the Netherlands is levied with an excise tax. The 2007 fuel tax was € 0.684 per litre or $ 3.5 per gallon. On top of that is 19% VAT over the entire fuel price, making the Dutch taxes one of the highest in the world. In total, taxes account for 68.84% of the total price of petrol and 56.55% of the total price of diesel.

- Even though Norway is the third largest oil exporter, the fuel is heavily taxed. The fuel tax for regular fuel pumps (gas stations) in Norway contributed to 63% of the fuel price in 2007 (The tax was USD 1.42 per litre 95 RON petrol). The government refers to the tax as environmental tax on fuels. The tax is subject to much controversy and debate in Norway, especially since Norway has a widespread population and lack of public transportation in rural areas. In 2008 the coalition government of Norway further increased the tax for petrol and diesel.

3.2 Fee-bate

France has enacted a bonus-malus system, which is essentially a feebate system for cars. More efficient cars receive a bonus when purchased, while inefficient cars receive a penalty when purchased. Details of this system and other penalties and taxes for the purchase of cars can be found here.

3.3 Buy-back

Some of the EU countries initiated programs to get older cars off the road in return for the consumer buying a more efficient vehicle. A few programs of this type are listed below:

- The scrappage program of France was introduced on January 19, 2009. The old car would need to be older than 10 years and the new car would need to meet a particular CO2 emission standard. It starts with 1000 for a car which emits a maximum of 160 g/km.

- o In Italy, there was a scrappage program from January 1, 2007, to December 31, 2008, that allowed for 700 plus a tax rebate. A new scrappage program is in place in 2009. New cars must comply at minimum with Euro 4 and emit a maximum of 130 g/km (diesel) or 140 g/km (other fuels) of CO2. Scrapping incentive for cars is 1,500 but can be combined with purchase incentive of 1,500 for a new car running on CNG, electricity or hydrogen (increased to 3,000 if it emits exactly 120 g/km and to 3,500 if it emits less than 120 g/km) The purchase incentive for a new car running on LPG is 1,500, which is increased to 2,000 if the car emits less than 120 g/km. This can also be combined with the scrapping incentive.

3.4 Penalties

The regulation on vehicle CO2 sets a penalty mechanism based on excess emission payments. If a manufacturer fails to meet its target in a given calendar year, it will be required to pay an excess emissions premium. The premium has been designed so that it will be paid for each gram per kilometre (g/km) by which the average car sold by the manufacturer in that year is above the target, times the number of vehicles sold by the manufacturer. A premium of €20 per g/km has been proposed in the first year (2012), rising to €35 in 2013, €60 in 2014, and €95 in 2015 and thereafter. It is expected that most manufacturers will meet their target set by the legislation and so that they will not have to pay significant penalties.

3.5 Other tax instruments

Many of the EU countries have various tax schemes in place to encourage the purchase of low CO2 emitting vehicles. These are laid out in another document that can be found here.

3.6 Registration fees

Registration fees are handled by the countries in the EU, although a common EU registration program was introduced. The common EU format was introduced by Council Regulation (EC) No 2411/98 of 3 November 1998 and entered into force on the 11 November 1998. It was based on a model registration plate which several member states had introduced.

The European Commission on 5 July 2005 presented a proposal for a Directive that would require Member States to re-structure their passenger car taxation systems. The Commission's passenger car tax proposal contains three elements:

- Abolition of car registration taxes over a transitional period of five to ten years.

- A system whereby a Member State would be required to refund a portion of registration tax, pending its abolition, where a passenger car that is registered in that Member State is subsequently exported or permanently transferred to another Member State.

- The introduction of a CO2 element into the tax base of both annual circulation taxes and registration taxes.

3.7 R&D

The Green Car Initiative, a part of the European economic recovery plan, aims to allocate €5 billion (US$6.7 billion) through a Public Private Partnership to bolster innovation in the automotive sector and sustain its focus on environmental progress. The initiative complements the European Clean Transport Facility which, through the European Investment Bank, serves to provide more immediate financial relief to the sector.

4.0 Traffic Control Measures

4.1 Priority lanes

Road policies to encourage low emission vehicles are set at the national level within the EU.

4.2 Parking

Sweden has a significant program on clean vehicles and as part of that provides free parking for EVs and other clean vehicles

4.3 Road pricing

Examples of road pricing in the EU.

5.0 Information

5.1 Labeling

Directive 1999/94/EC stipulates that a fuel economy label must be attached to the windscreen of all new passenger cars at the point of sale. This label must be clearly visible and meet certain requirements set out in Annex I. In particular, it must contain an estimate of fuel consumption, expressed in liters per 100 kilometers or in kilometers per liter (or in miles per gallon), and of CO2 emissions.

The Directive requires the prohibition of any marking relating to fuel consumption which does not comply with the above provisions and which might cause confusion.

5.2 Public info

EU Directive 1999/94/EC (as amended by 2003/73/EC) requires new car fuel consumption and CO2 emissions data to be made freely available to consumers. Car dealers are required to have a label showing the fuel consumption and CO2 emissions of each different model on display.

Fuel consumption figures will be expressed both in litres per 100 kilometres (l/100 km) and in miles per gallon (mpg). The label will list the figures achieved in urban, extra-urban and combined conditions separately. Dealers have the option to produce a new “comparative” label. The new label shows the mandatory Fuel Consumption and CO2 figures mentioned previously, alongside information about the appropriate VED band for the vehicle.

The directive also requires manufacturers to include fuel consumption and CO2 emissions data in all brochures and printed advertisements, provided that the literature relates to a specific model of car. These requirements were implemented into UK law by The Passenger Car (Fuel Consumption and CO2 emissions Information) Regulations 2001, which came into force on the 21st of November 2001.

5.3 Industry reporting

None

Back to top

The text above is a summary and synthesis of the following sources:

-

An, Feng and Amanda Sauer. “Comparison of Passenger Vehicle Fuel Economy and Greenhouse Gas Emission Standards Around the World.” Pew Center of Global Climate Change (2004): 1-36.

- An, Feng, et al. “Passenger Vehicle Greenhouse Gas and Fuel Economy Standards: A Global Update.” The International Council on Clean Transport (2007): 1-36.

Fulton, L. “International Comparison of Light-duty Vehicle Fuel Economy and Related Characteristics.” International Energy Agency Working Paper Series (2010): 1-70.

- Commission Staff Working Document – Impact Assessment Accompanying document to the proposal for the Regulation of the European Parliament and of the Council; Setting emission performance standards for new light commercial vehicles as part of the Community's integrated approach to reduce CO2 emissions from light-duty vehicles. http://eur-lex.europa.eu/SECMonth.do?year=2009&month=09

- Communication fro, the Commission to the Council and the European Parliament - Results of the review of the Community Strategy to reduce CO2 emissions from passenger cars and light-commercial vehicles. http://eur-lex.europa.eu/LexUriServ/site/en/com/2007/com2007_0019en01.pdf

- European Commission, http://ec.europa.eu/clima/faq/transport/vehicles/cars_en.htm

- “Passenger Vehicle Greenhouse Gas and Fuel Economy Standards: A Global Update.” The International Council on Clean Transportation, 2007: 1-35.

- “Technology Action Plan Advanced Vehicles” Major Economies forum on Energy and Climate Change, 2009. Available on-line (http://www.majoreconomiesforum.org)

- “Ultra-low carbon vehicles in the UK.” HM Government, Department for Transport, 2009. Accessible at http://www.dft.gov.uk/adobepdf/187604/ultralowcarbonvehicle.pdf

- US Dept. of Commerce. Compilation of Foreign Motor Vehicle Import Requirements.

Additional Sources Used:

- http://www.greencarcongress.com/2009/05/clepa-eucar-20090507.html

- http://ec.europa.eu/environment/air/transport/CO2/pdf/issue_paper.pdf

- http://www.c40cities.org/bestpractices/transport/stockholm_vehicles.jsp

- http://213.131.156.10/xpo/bilagor/20030509053952.pdf

- http://ec.europa.eu/environment/air/transport/CO2/CO2_cars_regulation.htm

- http://europa.eu/legislation_summaries/internal_market/single_market_for_goods/motor_vehicles/interactions_industry_policies/l32034_en.htm

The text above is a summary and synthesis of the following sources:

-

An, Feng and Amanda Sauer. “Comparison of Passenger Vehicle Fuel Economy and Greenhouse Gas Emission Standards Around the World.” Pew Center of Global Climate Change (2004): 1-36.

- An, Feng, et al. “Passenger Vehicle Greenhouse Gas and Fuel Economy Standards: A Global Update.” The International Council on Clean Transport (2007): 1-36.

Fulton, L. “International Comparison of Light-duty Vehicle Fuel Economy and Related Characteristics.” International Energy Agency Working Paper Series (2010): 1-70. - Commission Staff Working Document – Impact Assessment Accompanying document to the proposal for the Regulation of the European Parliament and of the Council; Setting emission performance standards for new light commercial vehicles as part of the Community's integrated approach to reduce CO2 emissions from light-duty vehicles. http://eur-lex.europa.eu/SECMonth.do?year=2009&month=09

- Communication fro, the Commission to the Council and the European Parliament - Results of the review of the Community Strategy to reduce CO2 emissions from passenger cars and light-commercial vehicles. http://eur-lex.europa.eu/LexUriServ/site/en/com/2007/com2007_0019en01.pdf

- European Commission, http://ec.europa.eu/clima/faq/transport/vehicles/cars_en.htm

- “Passenger Vehicle Greenhouse Gas and Fuel Economy Standards: A Global Update.” The International Council on Clean Transportation, 2007: 1-35.

- “Technology Action Plan Advanced Vehicles” Major Economies forum on Energy and Climate Change, 2009. Available on-line (http://www.majoreconomiesforum.org)

- “Ultra-low carbon vehicles in the UK.” HM Government, Department for Transport, 2009. Accessible at http://www.dft.gov.uk/adobepdf/187604/ultralowcarbonvehicle.pdf

- US Dept. of Commerce. Compilation of Foreign Motor Vehicle Import Requirements.

- http://www.greencarcongress.com/2009/05/clepa-eucar-20090507.html

- http://ec.europa.eu/environment/air/transport/CO2/pdf/issue_paper.pdf

- http://www.c40cities.org/bestpractices/transport/stockholm_vehicles.jsp

- http://213.131.156.10/xpo/bilagor/20030509053952.pdf

- http://ec.europa.eu/environment/air/transport/CO2/CO2_cars_regulation.htm

- http://europa.eu/legislation_summaries/internal_market/single_market_for_goods/motor_vehicles/interactions_industry_policies/l32034_en.htm