Canadian Automotive Fuel Economy Policy

1.1 Background

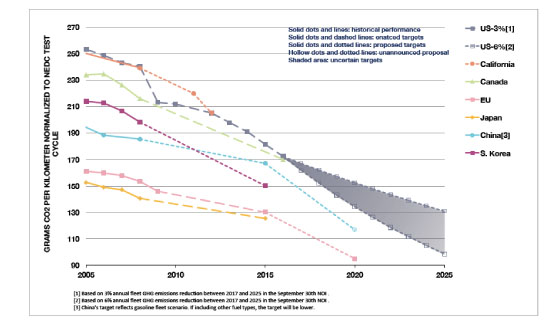

Vehicles in Canada are required to comply with emission standards for a defined “full useful life” – specified in years and as accumulated mileage, whichever comes first, and varies depending on the class or subclass of a vehicle. In April 2010, Canada released a draft regulation to limit GHG emissions from passenger cars and light trucks from model year 2011 to 2016. The standards will adopt the footprint-based structure proposed in the US latest rule making. While a more detailed analysis is being conducted, the Canadian government anticipates that the average GHG emission performance of the 2016 Canadian fleet of new cars and light trucks would match the average level of 153 g CO2/km (169 gCO2/km under NEDC cycle). This would represent an approximate 20% reduction compared to the new vehicle fleet that was sold in Canada in 2007.

Comparison of historical fleet CO2 emissions performance and the stringency of current or proposed standards for light-duty vehicles, across regions, courtesy of www.theicct.org

1.2 Canada Light-Duty Vehicle Fleet

Over the period 1988-2000, the average fuel consumption of new passenger cars was essentially flat, varying between 7.9 L/100km and 8.2 L/100km, and in 2000 was 8 L/100km. From 1993 to 2000, the combined new vehicle fleet fuel consumption average increased at about 0.1 L/100km per year. This can be partly explained by the increase in sales of pick-up trucks, vans and SUVs, which have higher fleet fuel consumption average than cars. In 2000, light-duty trucks made up 43 per cent of the Canadian light vehicle market.

1.3 Status of LDV fleet fuel consumption/CO2 emissions

See above.

2.0 Regulatory Policies

2.1 National Standard

Canada has a long history of voluntary agreements with the auto industry, which the government and industry initiated in the late 1970s to avert legislation. The initial program was designed to provide information on fuel consumption rates to consumers, and to improve the fuel efficiency of new vehicle fleets. The Transport Canada Voluntary Motor Vehicle Fuel Consumption Program, originally established in 1975, sets minimum levels of fuel efficiency performance for the auto industry, with separate levels set annually for new passenger cars and light duty trucks.

A company’s performance is measured by averaging fuel efficiency across the fleet. In November 2007, a law was passed to enhance the Canadian federal government’s authority to regulate vehicle fuel efficiency, and regulations will take effect in 2011. The new mandatory fuel standards for cars and light trucks will be harmonized with current and future US fuel regulations aimed at curbing carbon emissions.

2.2 Test cycle type

Canada uses the same test cycle as the United States. More information on test cycles can be found here.

2.3 Import restrictions

New Vehicles

For more information on this, see the Transport Canada Vehicle Importation website.

Second Hand

For more information on this, see the Transport Canada Vehicle Importation website.

2.4 Technology mandates/targets

In 1995, the Canadian government signed an MOU with the Canadian automobile industry in regards to targets to reduction of greenhouse gases from vehicles through the year 2010. The MOU commits major auto manufacturers and the Government of Canada to cooperate to reduce light duty vehicle GHG emissions in the year 2010 by 5.3 million metric tonnes of carbon dioxide equivalent emissions relative to a reference case. As part of this agreement, the auto industry is to offer, market and deploy GHG emission reduction technologies to vehicle consumers, and the government will lead various programs to encourage consumer awareness and education about purchase options for vehicles which would result in lower GHG emissions.

The agreement reached between the two parties is voluntary, and does not force a specific technology, nor does it add new regulations or impose fines for non-compliance.

3.0 Fiscal Measures and Economic Instruments

3.1 Fuel Taxes

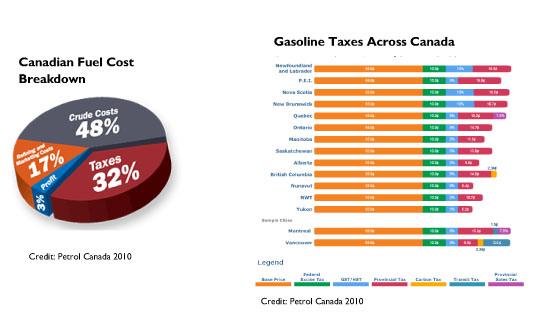

Taxes on fuel represent one of the largest components of the price of a litre of gas in Canada. In 2007 Canadians paid, on average, 32.5 cents tax on every litre of fuel. Taxes differ between provinces, which can lead to regional differences in the price of a litre of gasoline. The figures below show the cost breakdown of a litre of fuel, on average in Canada and gasoline taxes.

3.2 Fee-bate

Canada had a fee-bate program, called the ecoAuto Rebate program, which expired 31 March 2009. While it was functioning between 20 March 2007 and 31 March 2009, applicants who purchased or leased (12 months or more) eligible 2006, 2007 and 2008 model-year, fuel efficient vehicles could receive rebates ranging between $1000 and $2000. At the same time, the government levied a tax on fuel inefficient vehicles from $1000 to $4000 in its Green Levy program.

The ecoAuto rebate program applied to cars that got combined fuel economy of 6.5 L/100km (36 mpg US) or better and new light trucks that got 8.3 L/100km (28 mpg US) or better. The Green Levy program taxes vehicles, starting at $1000, which use between 13 L/100km and 14 L/100km, and increments increased by $1000 for every litre consumed up to 16 L/100km, at which point the tax was capped. The Green Levy tax became effective 19 March 2007, and any vehicle imported or purchased in Canada after 19 March 2007 will be subject to the excise tax. A list of 2007 model year vehicles, with their fuel-inefficient vehicle tax rates can be found here. For more information on fee-bate programmes, click here.

3.3 Buy-back

The Government of Canada has a buy-back program, called Retire-Your-Ride, whereby once approved to scrap your pre-1996 vehicle you are given a number of options to choose from, including public transit passes, membership to a car-sharing program, $300 cash or a rebate on the lease or purchase of a 2004 or newer vehicle. On top of the basic rewards, some auto manufacturers are offering cash incentives towards the purchase of one of their vehicles. Chrysler Canada is offering, for instance, up to $1,500 on certain models when you take part in the Retire-Your-Ride programme. Incentives vary between provinces as well.

3.4 Other tax instruments

N/A

3.5 Registration fees

Vehicle registration is handled by each province and territory independent of the federal government. Registration fees vary between vehicles imported from the US vs vehicles imported from any other country. Registration fees for vehicles imported from the US can be found here.

3.6 R&D

N/A

4.0 Traffic Control Measures

4.1 Priority lanes

The Ontario Highway 403 and 404 both have high-occupancy vehicle (HOV) lane along a section of the highway. They are demarcated by a striped buffer zone. Vehicles carrying at least two people may enter and exit only at designated points. Any vehicle carrying at least two people (including motorcycles), commercial trucks less than 6.5 meters long, and buses (whether empty or full) can use the HOV lanes. There are now approximately 150 lane kilometres of highway HOV facilities in 11 locations in B.C., Ontario and Quebec. There are also over 130 lane kilometres of arterial HOV facilities in 24 locations in Greater Vancouver, Calgary, Toronto, Ottawa and Gatineau.

4.2 Parking

N/A

4.3 Road pricing

Highway 407 in Ontario is an Express Toll Route, which measures 108 km and bypasses north around Canada’s largest city, Toronto. As the system uses cameras and transponders to toll vehicle automatically, users are sent monthly invoices and charged according to the distance travelled on the highway.

5.0 Information

5.1 Labeling

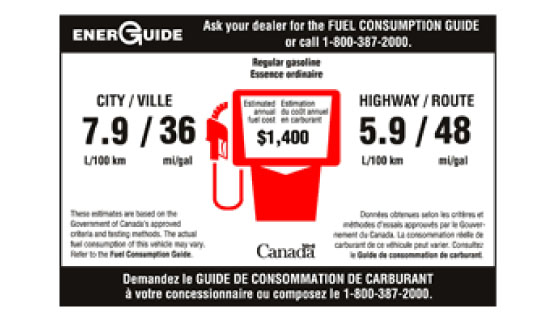

The EnerGuide label for vehicles is found on all new passenger cars, light-duty vans, pickup trucks and special purpose vehicles not exceeding a gross vehicle weight of 3855 kg (8500 lb). The label shows the city and highway fuel consumption ratings and an estimated annual fuel cost for that particular vehicle. Use this information to compare different vehicles. The label has a standardized design and can be affixed to the vehicle alone or as part of the vehicle options and price label.

5.2 Public info

Transport Canada's ecoTECHNOLOGY for Vehicles (eTV) program is helping to reduce the environmental impacts of passenger vehicles by making sure that the latest clean vehicle technologies become available safely and quickly in Canada. eTV does this by working with manufacturers to acquire and test and to address barriers to the introduction of new passenger vehicle technologies in Canada. eTV's test results also help inform the development of regulations, codes and standards for the next generation of advanced vehicles, including electric, fuel cell and plug-in electric hybrid vehicles, among others. 5.3 Industry reporting

5.3 Industry reporting

N/A

Back to top

The text above is a summary and synthesis of the following sources:

-

“Excise Tax on Fuel Inefficient Cars.” Canada Revenue Agency, 3 March 2007. http://www.cra-arc.gc.ca/gncy/bdgt/2007/xcs-eng.html

- ICCT Bulletins “Global passenger vehicle fuel economy and GHG emissions standards: January 2011 Update. http://www.theicct.org/passenger-vehicles/global-pv-standards-update/

-

“Review of International Policies for Vehicle Fuel Efficiency.” International Energy Agency, 2008. http://www.iea.org/papers/2008/Vehicle_Fuel.pdf

- Transport Division, Environment Canada, 2009.

Walsh, M. Car Lines. Issue 2010 (3), June 2010.

The text above is a summary and synthesis of the following sources:

- “Excise Tax on Fuel Inefficient Cars.” Canada Revenue Agency, 3 March 2007. http://www.cra-arc.gc.ca/gncy/bdgt/2007/xcs-eng.html

- ICCT Bulletins “Global passenger vehicle fuel economy and GHG emissions standards: January 2011 Update. http://www.theicct.org/passenger-vehicles/global-pv-standards-update/

- “Review of International Policies for Vehicle Fuel Efficiency.” International Energy Agency, 2008. http://www.iea.org/papers/2008/Vehicle_Fuel.pdf

- Transport Division, Environment Canada, 2009.