Russia’s Developing Automotive Fuel Economy Policy

1.1 Background

Steady economic growth in Russia over the last decade has contributed to a rapid increase in motorization, and during 1995-2006, private car ownership grew by 84%. By 2015 Russia is expected to become Europe’s largest car market. In 2010, passenger car sales rose by 30% to 1.78 million units and the full growth potential for car ownership is still far from being fully met. Personal car ownership in Russia remains below average levels in most developed countries, i.e. 160-260 cars per 1,000 inhabitants as compared to 460-500 in EU and 600-750 in USA. The Russian transportation sector was responsible for 25% of final energy consumption (94.4 mtoe) in 2005. However, a report by the World Bank Group (2008) indicates that Russia can reduce the energy consumption in the transport sector by 41% compared to 2005 levels, indicating that large reductions in emissions from the transport sector can be achieved with current technology.

As in many other regions of the world, vehicle use is concentrated in urban areas, resulting in congestion and poor air quality. Road transportation is responsible for 48% of all energy consumption in the transport sector, and has the largest potential for improvement in terms of energy efficiency and pollution reduction. A handful of pollutants, primarily PM10, SO2 and NOx, are responsible for 90% of human health risks from air pollution in Russia. .

Potential to improve energy efficiency in transport (mtoe), Russia

.jpg)

Credit: World Bank Group, 2008: 59

1.2 The Russian Light-Duty Vehicle Fleet

Road transport is a rapidly growing energy consumer in Russia, as the private vehicle fleet increases and public transport infrastructure and ridership deteriorates. Furthermore, low levels of investment in public infrastructure are coupled with few incentives for consumers to purchase more fuel efficient vehicles, resulting in an increase in larger, more powerful, more inefficient vehicles. Of the light-duty fleet in Russia, 51% of the vehicles are older than 11 years.

1.3 Status of LDV fleet fuel consumption/CO2 emissions

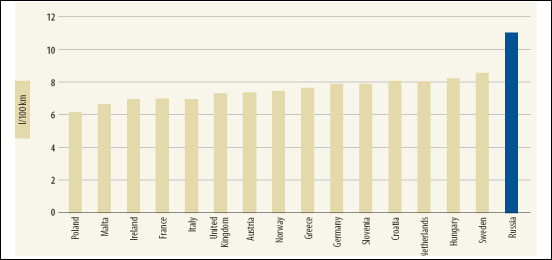

According to International Energy Agency estimates, the national fuel economy average for Russia was 8.33 L/100km in 2005 and 8.11 L/100 km in 2008 with a reduction of .9%. The Global Fuel Economy Initiative estimates the 2005 global average at 8.04 L/100km, with the goal of reducing the average to 4.02 L/100 km by 2050.

Under the business-as-usual scenario the number of cars will reach 400 vehicles /1,000 inhabitants by 2015 (almost on par with Western Europe), and road transport GHG emissions will rise from 100-110 MtCO2/yr up to 180 MtCO2/yr.

Comparative Energy Intensities of Passenger Cars, 2004

Credit: World Bank Group, 2008: 61

2.0 Regulatory Policies

2.1 National Standard

There is currently no national auto fuel economy standard, although there is growing government interest in curbing greenhouse gas emissions from transport. Russia adopted a national energy strategy in 2009, aiming at a 40% increase in the energy efficiency of transport within the timeframe of the strategy, through 2030. In 2008 a presidential order on “Measures to improve ecological and energy efficiency of the Russian economy” prioritized energy efficiency, including the transport sector. The World Bank estimates that potential CO2 emission reductions from interventions in Russia’s transport sector are 100 MtCO2/yr and 50 MtCO2/yr from road transportation.

2.2 Test cycle type

None

2.3 Import restrictions

New Vehicles

Vehicle conventional pollutant standards are at Euro 4 from January 2010 and Euro 5 from 2014 for new domestic and imported vehicles. An age-based taxation system is in place for imported vehicles: 30% tax increase on imported cars older than 1 year; 35% tax increase for imported vehicles from 3 to 5 years old; for vehicles older than 5 year the tax is within 2.5 and 5.8 Euro per cm3 of engine volume.

Second Hand

See above

2.4 Technology mandates/targets

Although it is unclear whether Russia has instituted technology mandates, private ventures in hybrid vehicle technology exist.

3.0 Fiscal Measures and Economic Instruments

3.1 Fuel Taxes

Differentiated fuel taxes are in place, based on octane and quality.

3.2 Fee-bate

N/A

3.3 Buy-back

A national buy-back program was initiated in 2010.

3.4 Other tax instruments

Regional governments apply an annual transport tax, linked to the horsepower of the vehicle, but collection rates are low. Further, the tax is too low to have much of an impact on vehicle ownership or choice of vehicle technology and efficiency. For imported cars older than 1 year, there is a 2.80 Euro tax per cm3 (cc) of engine volume. For vehicles other than 5 years the tax is within 2.50 and 5.80 Euros per cm3 engine volume.

3.5 Registration fees

N/A

3.6 R&D

N/A

4.0 Traffic Control Measures

4.1 Priority lanes

N/A4.2 Parking

N/A

4.3 Road pricing

There are no congestion or road pricing programs in Russia.

5.0 Information

5.1 Labeling

N/A.

5.2 Public info

N/A

5.3 Industry reporting

N/AThe text above is a summary and synthesis of the following sources

- “CO2 Emissions From Fuel Combustion,” International Energy Agency, 2011. http://www.iea.org/co2highlights/co2highlights.pdf

- ”Energy Efficiency in Russia: Untapped Reserves.” World Bank Group, 2008

- UNEP Country Questionnaire on Auto Fuel Economy Policies for Russia, 2010

- “International comparison of light-duty vehicle fuel economy and related characteristics.” IEA/ETP. 10 May 2011. http://www.globalfueleconomy.org/Documents/Updates/Bibendum2011-May2011-IEA-Fuel-Economy-Report.pdf